Leaderboard

Popular Content

Showing content with the highest reputation on 10/30/19 in all areas

-

Just wanted to say thank you to everyone who has posted about VAT. I have been dipping in and out of the forum whilst considering our VAT claim and it has been so useful I thought I would share our experience as it is a little more unusual. We have built two properties in our back garden one for me and my wife and one for our son. I project managed both and to help our son with finances we only charged him the net amount for materials, bearing the burden of his VAT until the end so we had a lot riding on the claim! We were confident that as I had built both properties for family members there would be no problem with the claim being in my name but we did misjudge the claim deadline which has given us a few sleepless nights. Throughout the build I had the completion certificate in mind as "the golden ticket". My wife and I moved into our house in 2018. There were a few outstanding items but nothing major apart from landscaping. Our son has only just moved in. The properties were built alongside each other at the same time but his was delayed for a few months due to his finances. Since moving in, we have badgered our building control company for the completion certificate but there was always something minor that needed doing so we only received an interim certificate in August. That's when we began to panic after reading several posts about moving in date v completion certificate. We were confident we would get the VAT on our sons property but began to wonder if we had missed the boat for ours. After reading a post about a build being "one project" I called the helpline and asked how I should sort the invoices for both properties e.g. could they just all be put together as it was one project. They said we should submit them altogether, not separated into the two properties. I found this really odd as it seemed to me it would make it much more difficult for them to wade through but it did support my argument that it was one project. I used the spreadsheet provided on here (thank you) which is much easier than writing up the form. I also attached a note being completely honest that we had moved into our property in 2018 but that as it was one project the other property was not quite finished and enclosed interim completion certificates for both. I also explained that a handful of the invoices had been ordered by our son and his partner so were not in my name. Like many on here, we sent it off with everything crossed. After a couple of weeks on 5 September we received the initial letter confirming they had everything and tentatively hoped this was good news. That letter said we should hear again within 6 weeks. After 6 weeks I called the helpline for an update but there was a recorded message saying that claimants should wait another 30 days. Finally on 21 October we received our package back and opened it with bated breath. They had agreed to the whole claim with just a query on 3 invoices and said we would receive payment in 20 working days. Two suppliers should not have charged VAT so we have re-claimed that from the suppliers. The third invoice was a deposit for stairs which had no breakdown so we have resubmitted that to HMRC with a copy of the quote referred to. We were so relieved and hope this information may help someone else.4 points

-

3 points

-

Hi everyone. I am a retired brickie, although I haven't been "on the tools" for many years. My wife and I built our own house in 1980 when we were just 20 and 21. It was part of a self build scheme of about 10 houses in Wiltshire and we queued on the Council steps all one snowy weekend to secure our plot. With the enthusiasm of youth and only just out of my apprenticeship, we approached the bank manager for a mortgage along with the equity from the first house we'd bought 3 years before and with lots of advice from my developer employer it all paid off and we ended up in a 4 bed house which set us up for life. Seven years and two children later we decided to return to the south coast where we were from and bought a 30s bungalow with a huge garden which we extended. Over the 30 years we were there we occasionally had developers enquiring about our garden but nothing ever came of it and eventually we were landlocked anyway. In 2014, retirement was looming and we had many discussions about downsizing but we loved the area and nothing seemed right so we decided to make some enquiries about whether we could get planning in the back garden with access down our drive. Our initial thoughts were that we would sell the house with PP if we were able to. Anyway to cut a long story short, after a year of discussions with developers who gradually squeezed the numbers too much, we decided to go for the PP ourselves to build 2 properties, one for us and our son decided to let his Dad build his first home on the other plot. The cost of obtaining the PP was huge without any guarantees and loads of stress, CIL on the horizon and slow slow planners. Eventually we were very lucky to get the permission. Next came the mortgage issue. Approaching our sixties, lenders were unwilling to let us have a conventional mortgage on our existing house ( our preferred option) and the terms were too short so we went for a more expensive self build mortgage which would be repaid by the sale of our house at the end of the project. I was the project manager for both builds and my wife dealt with the finances. Our son got his own self build mortgage and we all put our stage payments into a central building account which we used for the build. I used local trades and I mucked in wherever I could to help. Being able to remain living in our existing house on site made the build really easy to organise and monitor. For costings we used various methods including estimators online and with some tight budgeting we have come in exactly or just under budget for 2 four bedroom, 2 en suite properties traditionally brick built. I have dipped into this forum occasionally but in particular for information on the VAT reclaim. We took our sons VAT on board and only charged him net costs to help with his budget so we had a lot riding on the claim. The forum has been so helpful in this respect and I will post my experience with the claim in the relevant section.2 points

-

2 points

-

Thought I give an update. Not that anybody is really worried, but some adventurers might read and want to try similar. I now hired a piling contractor. He's a brilliant guy (so far) and keeps up with all my bullshit. I decided against diy for once. Like many mentioned. It s too much of a specialist job. I would like to do it, but I'd rather not take the risk of failure at the end. Can still diy the rest so plenty to do.1 point

-

and i would think if you get a good result it will improve once the cellulose goes in.1 point

-

Rather than a "conservatorry" I would choose what is now generally referred to as an "orangery" which means it has a proper insulated solid roof.1 point

-

+1 to putting conservatories on the N side not any other for practicality and use for more than half the year, and for maximising wall if you have one, plus high insulation etc. But for a relatively very small only 1/3 difference I would do the extension. If you are doing a conservatory you want it to be 60-80% cheaper imo than the extensions, as it will not add value unlike an extension, or not as well. If money saving is the real object then get a second hand conservatory ... loads of people upgrade to an extension, or put it on the south side and nearly fry their dogs, or people who buy a house with a conservatory, and want a real room. Then plan to upgrade later (eg make your slab thick enough for a timber frame extension). Look on ebay. You can save 90% on the conservatory itself. There are even companies that deal in them and will come and install. I did a 4m x 6m one for £7k toto (secondhand conservatory cost was £600, delivered) including excavations and the slab etc, and insulation to a standard that it is now the lounge, and a tin roof as it had wooden joists and could not be seen easily. I deliberately went for one with "insulated lower half" panels to have something that I could just attach to a flat slab and wall / wallplate with appropriate screws and thunderbolts. (And industrial amounts of sealant.) The trick is to know what will work for you, and wait for something that will fit within your parameters, then check it carefully. Wait for one that is local and GO AND LOOK AT IT BEFORE BIDDING. Or reduce risk and have a secondhand conservatory company do it for you. I put mine outside an external spec door to avoid some regs, and make sure that the house could be isolated. F1 point

-

It doesn’t have to show the VAT separately, that’s why there are 2 parts to the claim form. And it’s not just for items up to £250, I had an invoice like that for a few thousand and the reclaim was paid. It must have the VAT number on and the supplier, and preferably your name and say ‘invoice’. If it’s just a till receipt you may still be successful however. I did separate mine into 2 forms as per the online form.1 point

-

Yes no problem at all they accepted my whole claim even some that I thought they’d probably reject , paid out within 10 weeks of making the application1 point

-

Mine didn’t have two forms, all receipts were on the one list but obviously ones from shops didn’t have the vat separated, I just made the calculations myself and entered them in the appropriate column1 point

-

At 64 I am semi-retired and heading into my last self-build, did one 10 years ago in Ireland but its long enough to forget some of the grief! I started out thinking I would go the PM route and do some of the PMing myself but now leaning towards main contractor and doing bits and pieces myself, as I am happy with electrics (but not certified) and some plumbing work. Like installing a kitchen ,decorating, fitting lighting, home automation etc. What I have learned from my last build is that you can't do enough planning and estimating before you start any work, and you cant research everything to the degree where you have all the answers, so employing professionals you can trust and get along with is critical. Although my last build was largely successful, my target is to make fewer mistakes this time around. @PWS welcome to the forum!1 point

-

1 point

-

Hi newhome one plot is in my sons name and the other is in ours. I agree the HMRC guidance is not clear and we couldn't find any info on our particular situation anywhere so hope its useful. I think our conclusion was to be really organised, preferably as you go along and to include an honest summary of the situation if it is unusual. Even though my wife was organised with the paperwork it still took her many hours to compile it all for the claim.1 point

-

The answer is no, you don't. @pocster is the bloke who sold Tower Bridge to the Yanks. (Allegedly.) But they did not take delivery when it turned out to be a couple of defective skylights. They are double glazed so you could make a tall fishtank for anorexic fish. I have a standing offer of £2.01 in, so you will need to pay £2.02. And welcome.1 point

-

You can get an architectural technologist to do your planning and building regs fairly cheaply. With your budget and time constraints you would do well to go for a simple rectangle 2 storey house. 10m x 8m footprint would give you an internal area of about 135m2. You could design it so that it can be easily extended later. Timber frame with brick or rendered block with pitched tiled roof is fairly low risk construction and cost wise.1 point

-

1 point

-

I know it is a trade off with aesthetics and decent daylighting but designing out the problem glass would be my first priority where site conditions permit. Wall is far cheaper and more energy efficient than glazing. I often see self build and high end new build detached houses with loads of glazing, suffering from glare and overheating. With some of the brise soleil you can't even see out of the windows and it just seems like a load of expense for an affectation.1 point

-

RHI payment depend on how good your house is --the worse the insulation /bigger heat ;loss ,then the more you get this is why @JSHarris is so low --my house was assessed before i upgraded it --so therefore i get £807.91 per annum currently --it goes up every year by inflation rate started at £750.01 per annum so add the £1000 a year i save on LPG and the system will have paid for itself --by the end of the term of RHI and this is why on new build it may not pay to go MCS route -- mine did so if refurbing it pays to get your house assessed when it only just meets minimum requirement --then make it better later1 point

-

I joists are plenty strong enough to support a tray As long as you don’t cut or birch the top or bottom rails if you need to go through them it worth fixing 18 mi ply on the face of the osb that you have cut1 point

-

No, because those things are specifically not eligible. From the claim notes: Are you claiming for any other building(s)? In general, you cannot claim for any work that has been carried out on other buildings within the site as these do not form part of the eligible building work. Nor can your claim include buildings that are yet to be constructed. This means you cannot claim VAT back on any materials used on the construction of: • rooms above or attached to a detached garage • detached workshops or storerooms • sheds • stables • detached swimming pools • annexes (such as ‘granny’ annexes)–that cannot be disposed of or used separately from another dwelling because the annexe is not ‘designed as a dwelling’ in its own right.1 point

-

Three comments: 1 - Take as much time as you need to understand it all, as I have argued before. 2 - When you discover unexpected things underneath, then fix them properly. I am sure you will. 3 - I have had 2 bathrooms done this summer, which were inherited from the self-builder and were the wrong way round (bath downstairs) with basic problems. I have written about one so far in exhaustive detail, with links here. There may be useful information there, (If you pay much more than about £100 for a normal 8mm shower screen plus steady bar, you are overpaying. Ditto about £250 for a walk in shower tray, Ebay. Unless you have a specific requirement.) As ever, the moneysaving ethos is to find products of an acceptable quality less expensively and being set up to exploit that (eg advance purchase, storage space, some flexibility in spec etc), rather thank getting cheap products that turn out to be nasty. F1 point

-

1 point

-

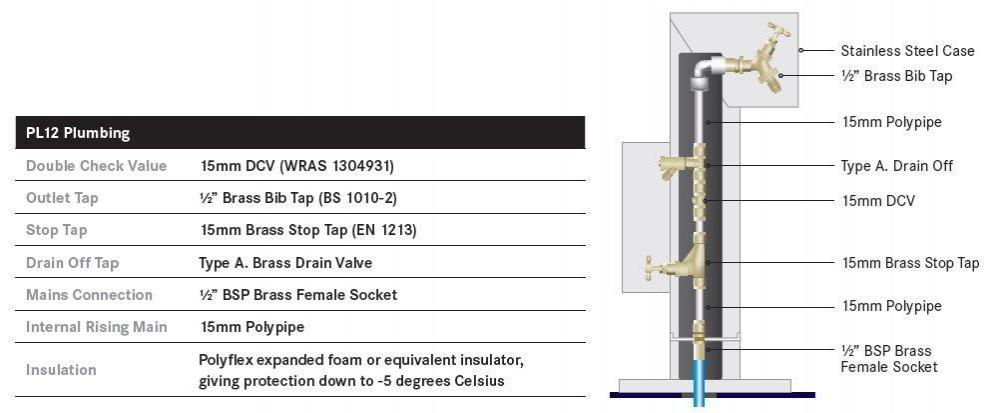

This is the arrangement we were given by Scottish water for our standpipe (which never actually happened as they took so long to make the connection) they were sticklers for how everything had to be done, 900mm down for the pipe , had to be through blue ducting with pea gravel and had to be in a straight line, we had it in a large sweeping curve to enter the house at the side but they wouldn’t pass it and we had to relay it in a straight line entering the building from the front.1 point

-

We received the attached from United Utilities. Might be worth asking SW Water if they have a similar document. A2 Temp to perm Wall Mounted (Normal).pdf1 point

-

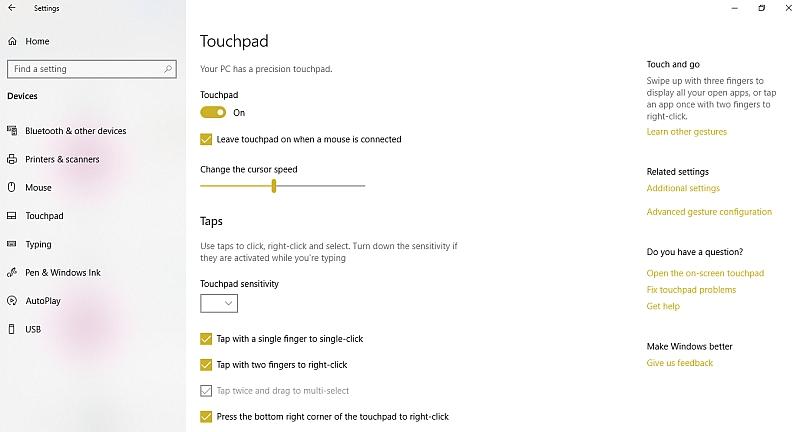

Your Utility company will answer all those questions (United Utilities in our case). For us the answers were; Yes. 900mm below ground level, with a protective wire reinforced plastic mesh laid at 300mm below ground level. There was no infill spec. But the inspector suggested ' ... soft earth ...' Use ducting. You need a non return valve and a stop tap.1 point

-

1 point

-

For the sake of £30 and ease install, I would do it all in ducting and then you have a much reduced chance of damaging the pipe.1 point

-

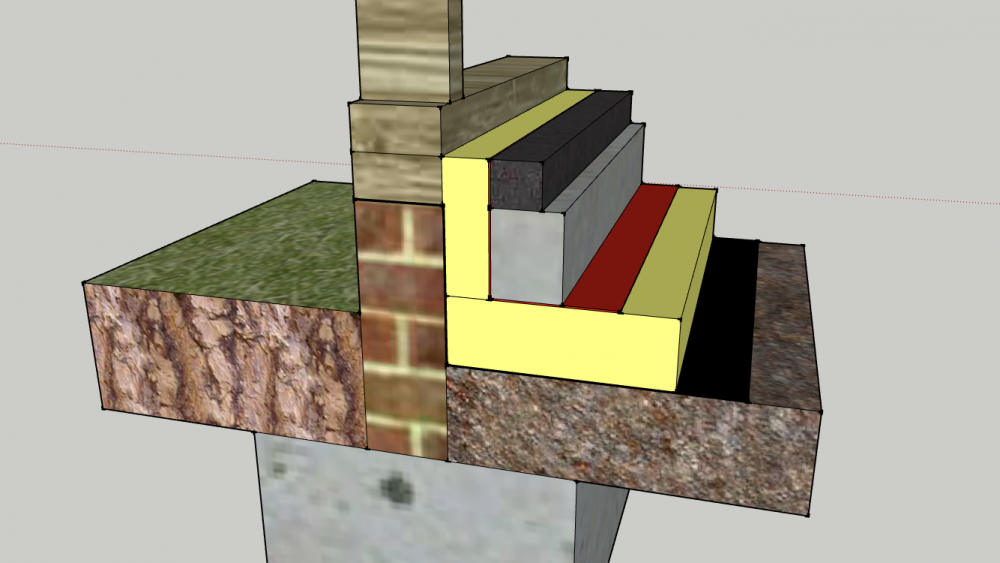

@jntabbycat you need to look at separating your timber sole plate from the cold brick, this is the area that causes problems, you can look at a product called Marmox, it is a structural insulation, you also need to look at your section drawing and design how your cladding will fit to the outer timberframe. I think you will find you will need an outer plywood, osb, layer then a breather membrane then a counter batten then cladding. By working this out you can determine where your frame sits in relation to the courses below, you may find to come in line with building regs you need minimum 140mm frame then osb then batten then cladding so you wall ends up being closer to 210 thick. Draw this up with marmox blocks underneath and you will end up with a far better building than just a glorified shed.1 point

-

1 point

-

I’ve drawn this. Think it’s ok based on what I can find online etc. not included makeup of wall just the timber. single skin wall on top of footing with baseplate fixed above dpc. From the bottom. 150mm blinded rubble or type 1 compacted, 1200 dpm, 75mm rigid insulation, vapour control layer, 100mm concrete, 50mm screed. Insulation around edge of slab 50mm thick.1 point

-

0 points

-

0 points

-

Oh I’ve done the same . Spreadsheet and every receipt in a folder - all numbered . Just didn’t want the tax man questioning when of course I’ll have no memory of why it doesn’t show vat .0 points

-

Yep - it’s true ! I sold sand to a man in a desert . I sold water to a man in a boat I sold hamburgers to a man in Mac Donald’s I sold brexit to the public What was sold to me ? . Some incorrectly sized fecking wall on glass . ?0 points

-

0 points

-

You'll need a few drums of Dettol then when you replace your cesspit/septic tank.0 points

-

0 points

.thumb.jpg.bac90f3bbf6868cf2118d010d936c99d.jpg)