Leaderboard

Popular Content

Showing content with the highest reputation on 03/30/20 in all areas

-

You could also argue why do I as SE pay pretty much the same NI as a PAYE employee? I don't get any SSP and in normal circumstances it is virtually impossible to go from SE to unemployed and claim any form of benefit.2 points

-

2 points

-

They tried to fix this before and there was a backlash, but I think this time it will get sorted out. Self employed pay less tax than employed and often they argue that it is due to lack of holiday pay and sick pay. Holiday pay is paid by your employer and not the government so this argument is nonsense. Even SSP although it would be paid by the government, employees generally have better sick pay because their employer pays it not the government. The average person is only sick 4 days a year in the UK. I am a partner in the company I work for so benefit from being classed as self employed so not paying employer's contributions on my wages. This is just bizarre that a partnership benefits from this. The systems should be brought together so that people do not alter the running of their affairs for tax purposes. Self employed, partnerships, employees etc should all have similar tax arrangements. I have a friend who works as an IT contractor. Because he works in IT he buys himself a top of the line computer to play games on every few years and claims it against tax. He was set up for years using an employee benefit trust and basically paying no tax at all. An employed person earning £40,000 per year pays £3,764 in NI and £5498 in tax. Their employer pays £4,561 in NI. A self employed person would pay the same amount of income tax, except they could probably get some deductions not available to an employed person. Their NI bill (Class 2 and Class 4) would be £2984. So the total tax and NI on a self employed person making £40000 a year is £8482 versus £13823 for an employed person. In reality the self employed person would effectively be paid the employer's NICs and then pay some tax on them. What do you get for your extra £5000+ a year - 1. The average UK person is off sick for 4 days a year - Let's call it a week £92 of SSP. 2. JSA - £73.10 a week if you have savings of less than £6,000. So for many people, nothing. Another way of thinking about it is that the self employed benefit from probably roughly 98%(Other welfare is about 3% of government spending and self employed are still eligible for some of this) of government spending but pay considerably less tax than employed people. On top of the calculations above they can further reduce tax liability through the use of dividends and CGT.1 point

-

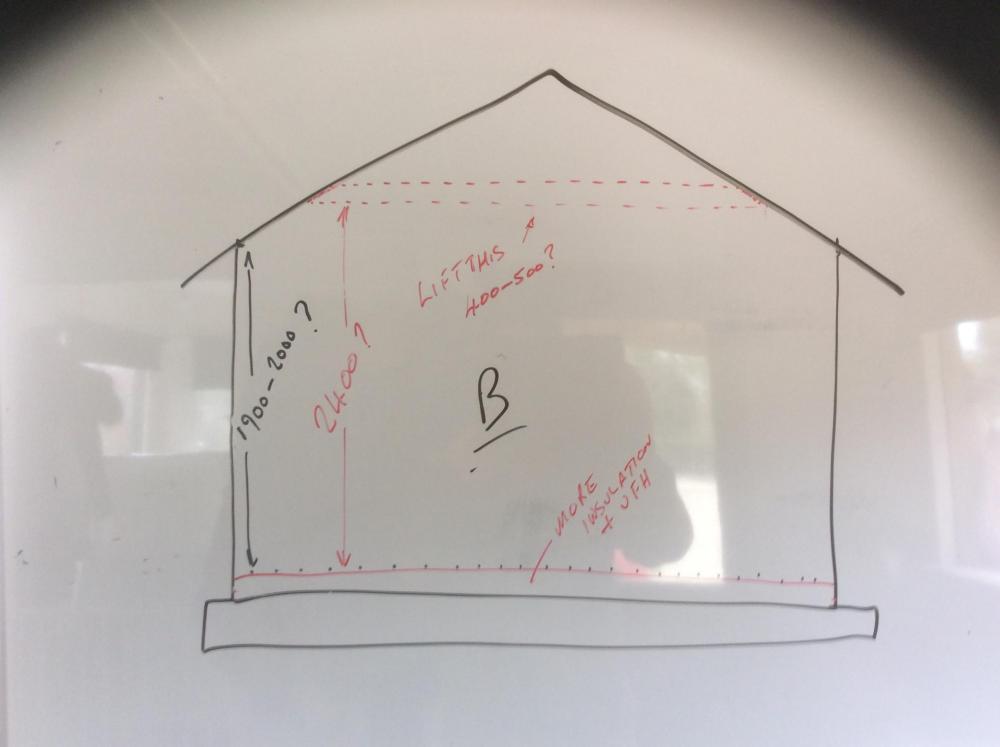

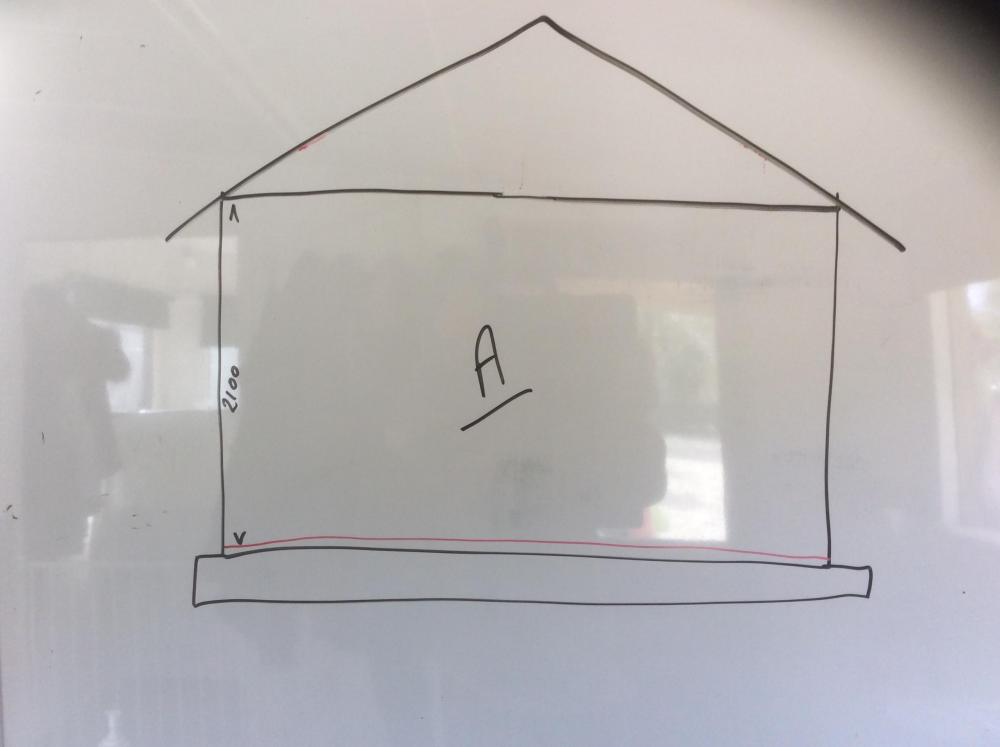

What's the extra inlet vent in the middle of the kitchen / diner for? I would have thought inlet at dining end and extract at kitchen end was enough. What is the stairwell thing? If there is a stairwell then there is an upstairs so where is the vent plan for that? Is it a bedroom at the moment with some plan in the future to convert the loft? Agreed put kitchen / diner vents on the centreline of the room, if for no other reason than aesthetics.1 point

-

But pretty much the same, is not the same...chancellor did say it was something that would have to be revisited, especially as you could argue that the current CV19 support is more generous (in that theoretically you could claim and continue to earn) If it means a levelling up on the benefit side, doesn't seem unreasonable, although the media commentators who scuttled the last chancellor's plans to do this would I'm sure argue otherwise.1 point

-

the design doesn't recognise things like joist direction and obstacles to routing. I'd wonder if the two l/h bedrooms might benefit from two duct runs each based on the length of run I'm intrigued by the supply vent in the stairwell finally perhaps the vents in the kitchen/dining/living end might need to be farther over to the right? Where will the cooker be?1 point

-

Correct @Thorfun, there is however a small additional thermal resistance that can be added to 'rainscreen cavities' such as yours. The cladding lowers the average windspeed in the cavity compared to the outside air. This allows what is called the 'external surface resistance' which is normally 0.04m2K/W to be increased to 0.13m2K/W. The external surface is the breather membrane on the inside of the ventilated cavity. See pages 11 & 12 of the attached pdf. BR_443_(2006_Edition).pdf1 point

-

1 point

-

1 point

-

1 point

-

1 point

-

Your accountant can clarify, but I expect your national insurance bill has been less for many years compared to that of the same taxable income of a employee or self employed individual trading. The less you pay into national insurance the less you benefit. As example if you paid £50 for property insurance you would clearly expect less from the policy than if you took out a policy for £500. It is a national insurance policy for the tax payer. National insurance contributions really serve two purposes, to help people as a safety net in the present but also to help in the future. Your prior contributions would provide qualifying years for a future state pension. Unfortunately what you have paid previously won't make any difference to the present. I don't think it is correct to say that no one really knows about SE and property income, most competent accountants would know how to deal with it on a self assessment and I have also applied some logic as to why it is not covered under the government schemes. I have to go back to the books now!1 point

-

Silvered membranes can increase the thermal resistance of unventilated cavities next to them. By default around 0.25m2K/W or higher if tested as those already mentioned (over an ordinary cavity of 0.18m2K/W) It is important the cavity is unventilated as it has no effect on ventilated cavities. Unventilated is deemed to be no more than 500mm2 of openings per metre length of wall.1 point

-

It should do - you have to do very little to legally commence work - see Section 56, particularly the examples in part 4 : http://www.legislation.gov.uk/ukpga/1990/8/part/III/crossheading/meaning-of-development1 point

-

I think in your case it would sound as if you might benefit indirectly from the government schemes. I would assume from your posts that the majority of your taxable income has come via property income. I would expect you have not paid class 4 national insurance contributions (and just a small amount of class 2). This would have saved you a lot of national insurance over the years compared to if your total income had been through class 4 as trading self employed or PAYE. National insurance was designed to be safety net and those who contribution most to NI are those who stand to benefit most when in need! If your property income was say £40,000 and I earned the same amount as employee but had to pay significant more national insurance, how would this be fair and just on the employee?1 point

-

The 7 tenants should receive theirs wages as normal from their employer, it's the employer who will have the time delay in reclaiming. I would imagine although employees may be earning less, there day to day living costs should also be less (commuting, motoring, disposal income on nights out etc). My understanding for the self employed scheme was that you needed just to have the 18/19 year filed (assuming the other criteria are met) so they should be eligible if they have filed just 18/19. Depending upon their circumstances they may qualify for the government backed loan, grant, or be able to delay a VAT/Self assessment payment for example which might free up some cash for the rent before being able to reclaim the government funds in June. The tenant that just left are you able to claim from his deposit. I'm not familiar with tenancy agreements. I wouldn't panic just yet, worth having a calm chat with each tenant to see what help they are able to access. As mentioned before I would have a chat with your accountant to see if they have any further suggestions for you personally.1 point

-

Go back to them on email to the transport department / accounts identifying that the delivery is short and asking for the additional items or credit. If it’s within 2-3 days then it should be fine.1 point

-

1 point

-

not saying don,t use a coupler,probably fine --but if worried about seal -use that along with tigerseal when it comes maybe?1 point

-

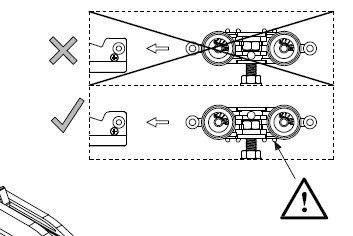

Yes that is the coupling. Chamfer BOTH ends of the pipe really well, use plenty of lubricant, slide the slip coupling onto one pipe all the way over, offer the 2 pipes up and then slide it back. Don't forget to mark the pipe so you know how far to slide it back. And just to say it again a really good chamfer and plenty of lube.1 point

-

You wold need to make a section that filled the piston ring cut otherwise you would have a hole. My idea was really to seal around the face of joint if there was a leak though a previous glue job.1 point

-

Am I missing something? What you want is a slip coupling in that straight section, so you assemble the two ends then join together with a slip coupling. I would use a push fit slip (not even sure you can get a solvent weld slip coupling)1 point

-

if you wan to test it -so your happy join a couple of bits leave a couple of hours or overnight and try to split them - and just push them half way in -and see the grip you get1 point

-

1 point

-

I just had this back from one planning consultant: This condition seems to me to be completely unreasonable. Councils cannot remove permitted development rights from a whole house when the application related only to a front extension. I don't think I have ever seen a council try this before. One of the 'tests' of a planning condition is that it must relate exclusively to the development being proposed. In your case, the development is the front extension but the condition stops all other extensions under PD (including rear extensions and roof extensions, for example). I can see what the council is trying to achieve. National policy limits extensions in the Green Belt and the council therefore decided that they would grant permission for the front extension but that, in compensation, future PD extensions should not take place. However, this approach is not valid. If the council was determined to remove the PD rights as part of a quid pro quo, it could only be achieved (as far as I know) though a legal agreement. Conditions should not be used in this way. I recommend that you apply to the council to have the condition removed. I would charge a fee of £1,000 plus VAT, 50% of the fee payable upfront and the remainder when the application is ready to be submitted. There is an application fee of £250 to the council. The fee includes a detailed supporting statement that sets out the government's position and relevant case law and explains why the condition is not justified. Hopefully, the council would bow to the logic in the supporting statement. If it is stubborn and the application is refused, I could appeal the refusal for an additional fee of £400 plus VAT. Any thoughts?1 point

-

1 point

-

I won't speculate on @pocster's position, but it is different for every landlord. My business is a mixture of single family lets and a couple of student houses. My tenants tend to stay long term (if they settle in 2-3 years up to 10+ years). The only couple I have lost quickly recently was back in 2018 when they realised after a few months that I was right when I told them at the start that they could afford a house and were silly to plan to rent long term, and bought somewhere and moved out. It was amusing but expensive that at the start - even though they had 2 family members in the street and there had been an advert on the house window whilst it was being renovated - they still went through the agent rather than direct, and that cost us about £500 each. Need some work on the feet-on-the-ground front ?. I have a couple of Ts who may be under threat of layoff, but should be covered by the 80% as employees though they will lose overtime. Another has lost a pension topup income from renting out a holiday caravan - site fees have been paid, and the whole summer's bookings have evaporated and the site has been locked down. For another online translation income seems to have stopped. But on the other side students are funded per year, and the finance has not been withdrawn, and my students for 2020-2021 year were all signed up with full guarantors by Nov 2019. I have offered reductions if people really struggle. I also have a couple who are on Housing Benefit, such as it is. I will be scoped out of the scheme by the income cap in all probability. OTOH an HMO rented to professionals by the room such as contractors risks them losing their income by being terminated, and the HMO is liable for Council Tax (unlike my student houses). The Council Tax liability on such a house could be between about £1000 and £8000 pa, as some Councils treat each individual room as a separate Band A dwelling for Council Tax purposes. But I am aware of a senior professional renting in the Lake District who is now desperately looking for somewhere else, as they have a short term let in a Holiday House whilst waiting for a big developer to complete their new house. But the developer has frozen the whole project, and the LL they are with now has cold feet about a long-term rental. And there is someone vulnerable in the house so they are advised to be socially disconnected for 3 months. And the whole market has largely stopped. But there are LLs where Ts have run away now offering free housing for the emergency to NHS Staff who are becoming persona non grata with housemates, or wanting to be away from families for safety reasons. I have a good friend who has split from girlfriend, and is now stuck in the same house as there is nowhere to go. None of it is easy, and the large majority of LLs who only have a single rental might struggle to take the hit, or just sell up afterwards. That will push the market faster in a corporate direction, which is what the politicians think they want - but has all sorts of consequences they do not consider. Ferdinand1 point

-

Wouldn't have thought so. Not heard any reference to 'unnecessary' work, just 'work', which you can continue to do following government guidance, working from home if possible. Having said that, there are a lot of businesses doing their own risk assessments about how and whether to continue to trade. If you're using a contractor, if you can find one open for business and following government guidance, I'd have thought you're good to go. If you're doing it yourself and it's not a full-time job, then l guess it's a bit trickier to call unless you live on site.1 point

-

I have the KOEMMERLING 88PLUS profile. Not alu-clad though. Seems like a decent product, 6 chambers and at PH standard. Purchased direct from the continent at fraction of UK cost.1 point

-

1 point

-

I have read a couple of posts on this, haven’t read them all life’s too short. But my thoughts are why does something have to add up money wise, if you think it will improve your home environment why does it have to add up that it equals out what it costs. Do you never ever go to a restaurant and think I would really like the big 24oz T bone steak, but it’s £29 and the 6oz burger is only £12 do you buy the burger because it represents better value or do you want a steak. I dont understand the comments of my MVHR cost £3000 but it saves me x from my heating, who gives a toss, from everybody on here who has it I haven’t seen anybody who regretted it, if it makes for a good living environment who cares what it costs.1 point

-

0 points