-

Posts

575 -

Joined

-

Last visited

-

Days Won

4

HerbJ last won the day on May 18 2020

HerbJ had the most liked content!

About HerbJ

- Birthday February 17

Personal Information

-

Location

Sunningdale Berks

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

HerbJ's Achievements

Regular Member (4/5)

292

Reputation

-

Recommendations for double/triple glazing unit suppliers?

HerbJ replied to Alan Ambrose's topic in Windows & Glazing

I helped my son and daughter in law with to source DGU's. They live in the New Forest so I can't recommend a supplier. However, I found that most traditional, and usually well established, glaziers/glazing companies in that area were very capable of supplying and installing replacement DGU's in existing window frames. They were also competitive and made a site visit and measure before finalising quotations. They also installed, after removing the old blown DGU's and removed all the old materials. the companies who supply and install replacement windows were only interested selling complete new windows/frames or supplying DGU'S that were not specified for the existing windows, because they only supplied DGU's which were suitable for modern plastic frames formats (too thick for the existing frames). -

I have PAUL Novus 450 MVHR for a 5 bed house. I don't live a a city environment but in a semi-rural environment but near to a busy road. PAUL recommend changing the filters every 3 - 6 months. They are synthetic material/paper filters that cannot be cleaned, so have to be replaced. I change the inlet F7 filter every 4 months approximately as they get very dirty - see photo I change the G4 exhaust filter every 2 years or so

-

Critique my MVHR plans - round 2

HerbJ replied to Sparrowhawk's topic in Mechanical Ventilation with Heat Recovery (MVHR)

+1 to this but and you seem to have covered most of the key points. The big question/issue for me is the detailed routing of the ducts, particularly downstairs, in locations where you haven't negotiated "permission" to reduce ceiling height. There is still a lot of investigation and detailed work to be done to ensure that you are able to make penetrations in floor joists without compromising structural integrity BEFORE you start installation. -

Looking good I can see that you have made significant penetrations in your I-joists. Holes may be cut in I -beams but only in accordance with manufacturer's guidelines/rules - see typical guidelines at https://elliotts.uk/ideas-and-advice/i-joist-faqs Have these penetrations been checked by your SE for each specific location to see if acceptable ?

-

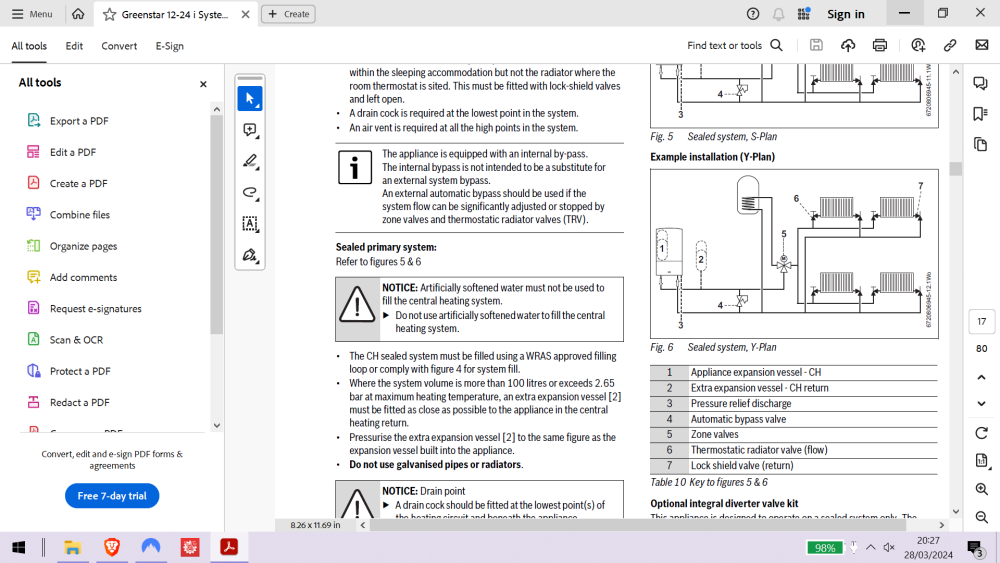

Most gas boilers specifically prohibit the use of "artificially softened" to fill central heating systems, which why the heating system fill-point should be from the mains supply I seem to remember it caused problems with the heat exchangers? I attach the relevant page from WB Greenstar system boiler, which is now 8 years old. Maybe not problem with ASHP and modern UFH systems and it should be checked

-

We had a similar design challenge for our garden design and we used a landscape designer to help solve it. I provided a lot of detail in this post, which may be helpful

-

Have you tried https://www.vieffetrade.eu/ ? They are Italian suppliers, offering a wide range of electrical goods, furniture etc, and they do deliver to UK.

-

H Ian Something you may want to consider. Though they may not suit your situation on a country road..... Outside our community in Spain we have a very busy main road and our main entrance is on a the brow of the curve. We introduced "traffic calming" by installing bollards in the midle of the road, in an attempt to stop drivers overtaking on the blind bend it's a 40kMph speed limt raod, but not unusual for cars to ovrtakinga 80/90 and , occasionally they still go on the other side of road(and the bollards) to overtake! Anyway, we originally installed expensive bollards and they kept being wiped out and cost us a fortune in replacing. In Late 2021, we came across a slimmer and cheap bollard and replaced the lot. The replacement are still standing, though when I looked again at the photos attached this morning a few were leaning and will need some attention this year. . I have no idea if they are available in the UK but I attach a couple of links to Spanish websites (hito is the spanish for bollard) https://syssa.com/es/senalizacion-vial/hito-vial/hito-h-75-desmontable-con-base-de-cauchohttps://gdstore.eu/145-hitos https://gdstore.eu/145-hitos https://www.signet.cl/hitos-viales/3458-hito-vial-amarillo.html

-

Merry Xmas to all Buildhubbers. Best wishes for a peaceful, successful and very Happy New Year

-

Really pleased you are recovering and will get back to full health. Thanks for letting us know and best wishes for quick and full recovery.

-

True, but in my case several microinverters (I have 14) failed to communicate properly and, then not at all, over a 2/3 month period. Enerphase carried out some remote monitoring and reported back as follows: The tests for the Envoy R show us bad communication performance. We advise you to purchase a new Envoy for this system. Furthermoore, looks there is some noise on the power lines hampering the signal of the Envoy down to the inverters. You can install Ferrite Torrids on the wires as they feed into the breakers. These rings help filter out noise. You will need to install these rings on all of your breakers EXCEPT what's on the Envoy and what's on the solar (see attached doc). The best way to solve this issue is to install a dedicated outlet at the sub panel where the solar feeds. More often than not, it corrects communications issues. I couldn't understand how there was suddenly "noise" on the power lines after the system operating quite happily on the same newly installed system for 4 years without any problems. Also, no changes to internet provider or system. The Envoy was already supplied by a dedicated outlet, directly from the main board, in accordance with MI. I replaced the original Envoy R, as outlined above and no issues since February 2020. On the issue of warranty replacement of a microinverter, I suspect they will provide a replacement microinverter but not cover the cost of installing it in the system - labour, scaffolding for access, etc It's an interesting question, but let's hope it's not necessary. Keep us updated @Bitpipe....

-

It's an Enerphase problem with the original Envoy monitoring unit and, unfortunately, the warranty period was not the 25 years of the microinverters. Apparently, the PV system performs quite happily without the monitoring unit but the data it provides is very useful.

-

Hi They're still active and usually responsive. I recommended them to someone last week and they have been helpful with him. I replaced mine with the Envoy S Metered because they told me that the Envoy S (the direct replacement for the original Envoy) was only £80 cheaper than the Envoy S Metered. I have looked online and the difference seems to be about £150+. the difference is that the S Metered has to be hard wired with CT's as it monitors the imported electricity and is capable of monitoring a Enerphase battery installation as well. If you don't need this, then the direct replacement may be OK and will be a easy direct swap. Have a look and see what you think? They moved offices Techfor Energy Ltd Big Yellow Storage Unit 1 Cobbett Park, 22 – 28 Moorfield Road Slyfield Industrial Estate Guildford, Surrey, GU1 1RU T: (0800) 888 6544 www.techforenergy.co.uk I dealt originally with was the Technical Director, Glenn Ashby -Mobile: 07968 098 995 and he is still involved. The person who helped with the replacement of the Envoy unit was George Sands. Cheers Herb