-

Posts

7227 -

Joined

-

Last visited

-

Days Won

50

Everything posted by newhome

-

Can you use the excess solar with the GivEnergy charger? Can you prevent charging the battery with the excess solar? I think I might prefer to charge it via the grid overnight if the export tariffs remain higher than the cheap overnight slots.

-

Thanks. Yes my brother said I might need microinverters. Will have a look at the shading properly when I move in.

-

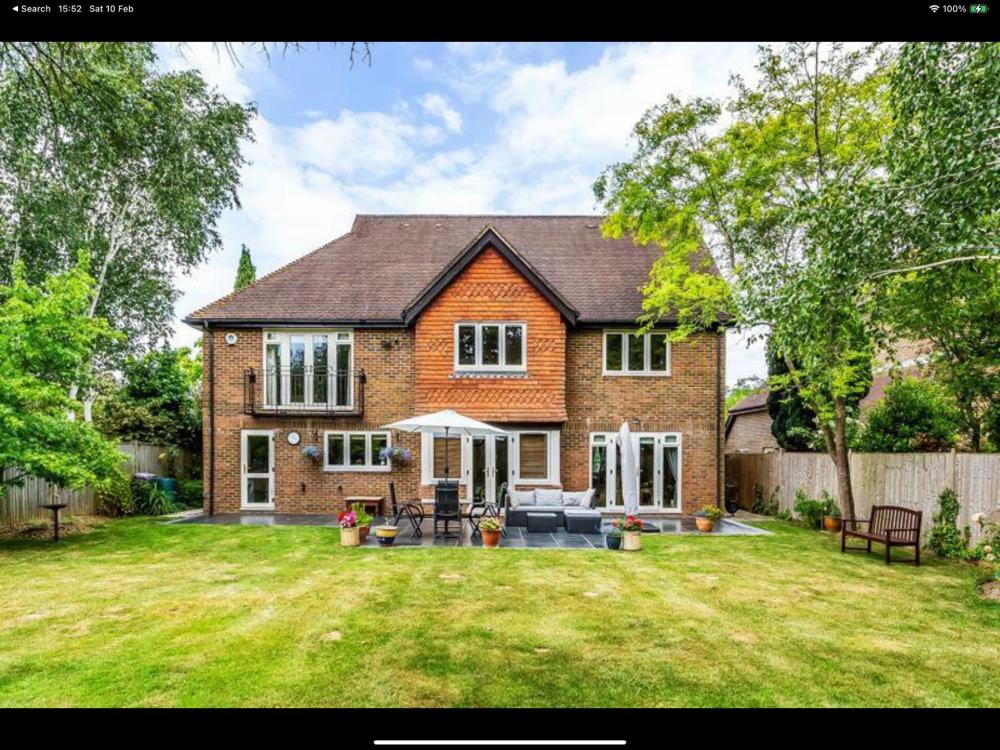

I’m moving into a new (to me) house at the end of the month and one of the first things I’m going to need is an EV charger. I also intend installing PV as I have a largeish south facing roof. Plus I’ve been thinking about installing a battery too. My brother has 3 lots of solar PV installed at different times, then he installed a Zappi, then an Eddi and finally a Givenergy battery. The system has evolved rather than being specified holistically to begin with and he currently can’t do all of the things on my wish list so I’m thinking that it might be best to have it all installed at the same time with a clear spec given to an installer. I have single phase electrics and my wish list is: 7KW EV charger As much solar PV as I can fit on the roof A battery (13.5 kWh or thereabouts but maybe that’s overkill?) Something to heat the DHW An app to control it all. I want to be able to choose whether to use the solar excess to charge the car, battery and heat DHW, or not, or whether to set to import from the grid at a time of my choosing. I don’t want the system to consider the EV charging as part of the general house load as I don’t really want to charge the car using the battery. I am planning to be on Octopus Agile so it may be better to export excess solar than use it to charge the car or heat DHW unless the Agile rates are off the scale on the odd day. Suggestions of set ups welcome please. I only really know about the MyEnergi products as my brother has them although he did not buy the Libbi when he added a battery recently due to cost. Photo of south facing roof

-

You are allowed up to 2 lodgers before a property is classed as an HMO. Unfortunately as you have taken in 3 lodgers you have unknowingly created an HMO in your house and have thus breached the self build exemption. https://www.gov.uk/rent-room-in-your-home/houses-in-multiple-occupation#:~:text=Your property may be classed,to more than 2 people. Be warned that there are many other regulations that govern an HMO that they might now come after you for!

-

Part 2 should be send CIL Form 6 Commencement Notice, wait for council to acknowledge, finish build and get completion cert As long as you don’t start anything before they acknowledge the form then you can’t be liable, but don’t forget the final step / documentation required in the euphoria of having finally finished.

-

Depends what your invoice says. If you have a completely separate invoice for materials and evidence that you paid the full amount to the builder then you can add the invoices to your VAT claim and add a covering explanation that your builder had to order the materials on your behalf as they had a trade account with the company. Also say that you paid the invoice in full and have payment evidence if needed. HMRC have definitely been refunding VAT paid on this basis (I know a couple of people who got it back). If your invoice shows both labour and the supply of materials then you will not be able to get the VAT refunded as a ‘joint’ invoice counts as supply & fit and must be zero rated.

-

No one can supply you materials at the 5% rate. This is for labour and supply & fit arrangements only so the only way you can benefit from the reduced VAT is to instruct a VAT registered builder unfortunately. On a ‘more DIY-led project’ you can’t benefit from the 5% rate unfortunately for work that you are doing yourself. The exception is for houses that have been empty for 10 years that are eligible for the VAT reclaim scheme.

-

If the invoices are in your name it’s highly unlikely they will ask you to prove who paid for them. Even if they did you can evidence that it was a family member who will be living in the property. They wouldn’t accept the invoice if it was paid by a company for example unless you could prove that you paid the full cost including the VAT but that doesn’t apply here.

-

Marker paint ?

newhome replied to LSB's topic in Self Build VAT, Community Infrastructure Levy (CIL), S106 & Tax

Oh sorry to hear that. Glad you are happy in your new abode though. I sold my self build and am looking for somewhere nearer family too now. -

Marker paint ?

newhome replied to LSB's topic in Self Build VAT, Community Infrastructure Levy (CIL), S106 & Tax

You sold your lovely self build?! -

Marker paint ?

newhome replied to LSB's topic in Self Build VAT, Community Infrastructure Levy (CIL), S106 & Tax

Strictly speaking for a new build you can only claim for materials bought supply only that you used in the fabric of the build. So marker paint for lines isn’t covered but paint is so just note it as paint and put the invoice in. You can claim for turf. It’s artificial turf that’s not eligible as it’s like carpet I guess. Hard landscaping, boundary fencing and gates (not electric components), topsoil and turf are all eligible. As you note you can only claim for trees and plants if part of a defined landscaping scheme. Carpets and thus underlay are not eligible but underlay for hard flooring is as hard flooring is eligible. Blinds are now eligible but curtains are not, but curtain poles are. There are definitely some nuances but most things are pretty straightforward really. The main thing to ensure is that you are invoiced at the correct VAT rate, especially if your build is going to take some time. For labour and supply & fit (for eligible work) a new build should be zero rated. HMRC will not refund VAT incorrectly charged so ensure that the VAT rate is agreed before you instruct the builder to do the work. If the invoice is wrong get it sorted straightaway, before you pay it as it’s much easier to do it then rather than trying to get a refund later. VAT adjustments can only go back 4 years so no good asking a business for a VAT refund from 5 years ago, or if they have gone out of business or if they have de registered for VAT. Also ensure that you have a proper invoice as HMRC will refuse pro forma invoices or ‘orders’. They will allow some retail till receipts but best to get a proper VAT invoice for larger spends. They often ask for window schedules if a breakdown isn’t on the invoice so if you have bought windows supply only save yourself some time and attach the window schedule to the invoice when you send the claim in. Similarly for kitchen cupboards or other large purchases for multiple items if there is not a decent breakdown on the invoice. You can send the schedule in later but you will get that invoice refused initially so just send it up when you submit the claim. There are some other nuances such as equipment hired is standard rated but a machine hired with a driver is zero rated. You could do worse than to have a read through this thread that covers quite a lot of these nuances (but probably not all). HMRC isn’t always consistent either. For example sometimes they have allowed a reclaim for a hob with built in ventilation and other times they have not. Luck of the draw in terms of who you get checking your claim really. Some builders don’t want the perceived hassle of zero rating either so sometimes you have to rule some builders out or bite the bullet and pay the VAT. -

+1. People lie or don’t do what they say they will all the time. The good news is that you paid by credit card with Section 75 cover and got your money refunded. That’s a savvy buyer. Warning bells to me are sellers who only accept bank transfer or debit card. I know lots of people who have lost their money that way.

-

A company can go back just over 4 years (to the beginning of the earliest tax year) to correct VAT. If the VAT originally charged was paid to HMRC they should be able issue a corrected invoice and adjust it in their VAT return. They won’t be paying you money out of their own pocket per se so it should be no biggy for them albeit a bit of hassle for them. If they didn’t pay the original VAT to HMRC then it’s fraud. Note that if a company deregisters for VAT or is dissolved then they cannot correct incorrectly charged VAT via a VAT return so you won’t have much joy if this is the case.

-

If it’s been empty for more than 10 years you can reclaim all of the VAT you pay for the actual build but not architects fees etc. For labour you should be billed @ 5% and you then reclaim the 5% at the end of the build. For supply and fit you should be billed @ 5% and you should reclaim the 5% at the end of the build. For materials you should be billed at the standard rate and you reclaim the 20% (in most cases) at the end of the build. Be careful to get the invoices billed at the correct rate as HMRC will not refund VAT that’s been overpaid. You will need to use form VAT431C for the reclaim. It doesn’t matter if you do the work yourself or someone does it all for you. What’s important is that it’s a project that you are doing for you or your family to live in. That’s pretty much the eligibility criteria that HMRC use plus other bits such as the house can’t have a business use occupation clause.

-

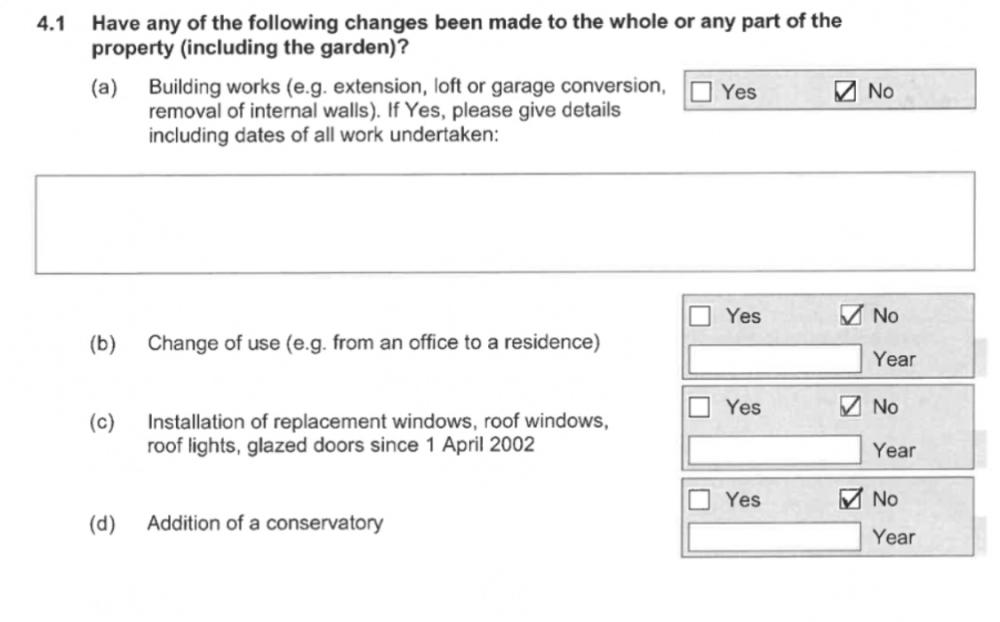

Thanks. My friend lives locally and has a very good builder who I plan to use. The Property Information Form doesn’t ask the specific question about doors being added but it does ask if I know of specific breaches further down.

-

Thanks. I’m not sure about the floor difference as yet but thought that I could place the frame 100mm higher than the floor level to create that if needed? If it’s just to stop potential flow from liquids then surely that would creat that effect? I did try to read up on how the door needed to open but most things I read seemed to imply that the door needed to open into the house but that’s perfect if it doesn’t have to.

-

This is the sort of thing you really need in writing from HMRC as anyone on here can only speculate, but I would expect you to be able to claim for the building approved by the revised plans but the new additions only to be reclaimable from the date that the amended plans were approved. You’ll need to amend through building control too. I would write to the DIY team at HMRC and explain that it’s now clear that the current plans do not meet your family’s needs and that you are considering amending the plans. Can they confirm that you can claim for materials purchased for the amended plans. Then you have it in writing although God knows how long they might take to respond. You could maybe add a landscaping plan but it would only allow you to claim for the plants and trees defined within it plus you are then obligated to that design / planting scheme. Turf and hard landscaping are reclaimable without one in any event.

-

I’ve sold my self build as I’ve moved location and am in the process of buying a new (to me) house. The house meets many of my needs but there is no access to the garage other than via the main garage door. Ideally I’d like a door from the utility room into the garage and I know that this needs building control but I’m not sure whether I can 100% conform to building regs. I know that it needs an external fire door fitted and that there needs to be a 100mm difference in floor level between the garage and internal space. I will also ensure that a lintel is fitted and that there is a ‘step up’ of 100mm into the house. I only have 890mm (36”) to work with however that will include the door frame. And as the utility room is small I would prefer that the door opens into the garage. I suspect that some of these things make it difficult to conform to building regs. I’m considering not bothering with building control as this is expected to be a house where I will live for a few years, then when I come to sell I can just get the door removed and the wall replaced if it’s a big problem for the eventual buyer. Convenience is more important to me than worrying about an onward sale. Are there any pitfalls to this approach that I may not have considered? There is a restriction in the planning permission that will not allow the garage to be converted into living accommodation but I don’t want to do that anyway, I just want to use it as it is for storage.

-

No timeline unfortunately but at least it’s a step in the right direction. Whether it eventually improves the customer experience in terms of time from submission to payment remains to be seen. “4.81 VAT: DIY Housebuilders Scheme Digitisation Project – The government will legislate to digitise the DIY housebuilders’ scheme and will also extend the time limit for making claims from 3 to 6 months. These measures should improve the overall customer experience and reduce the administrative burden for claimants and HMRC.” See link to full document Budget Spring Briefing 2023

-

- 2

-

-

Yes a precedent cannot be set for a tribunal case and HMRC may choose to ignore the outcome. The tribunal judges do generally look at previous cases however and often quote them in their decision reasoning. That said judges can rule as they see fit having interpreted the law so it often depends on interpretation. HMRC can say whatever they like on a claim form or verbally but if their ‘guidance’ does not correspond to the legal position then it’s not valid. The tribunal will only make a judgment based on what is lawful although tribunals have been known to criticise HMRC quite heavily.