Search the Community

Showing results for tags 'funding'.

-

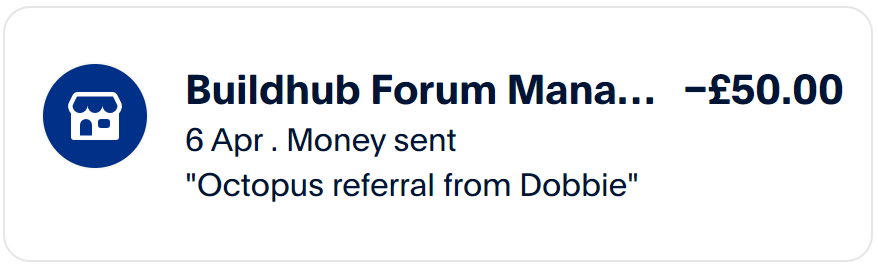

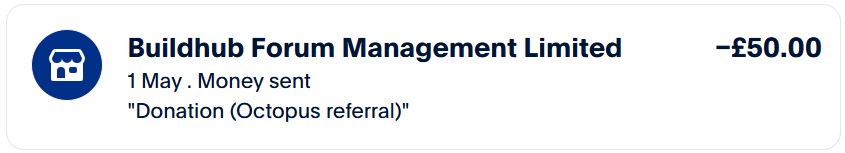

Help BuildHub financially while getting a £50 credit on your energy account! For anyone considering moving to Octopus Energy, please message me for a referral code. Using that code will result in £100 being split between you and Buildhub. When the credit arrives in my Octopus account, I'll transfer £50 to the BuildHub Paypal account and post a confirmation screenshot in this thread (or to you privately, if you prefer) as proof the transfer happened. As you know, BuildHub is a non-commercial forum run entirely by unpaid volunteers. We pay for hosting etc solely through member donations. If this referral scheme is successful, the need for periodic donation drives will significantly be reduced, or perhaps even done away with completely. Thanks for helping to fund the forum! List of referrals: @trialuser @Dobbie @Jenki @Originaltwist @Chanmenie - Code submitted 30 April 2024 - payment might be a while as not yet connected. @Mattg4321 - Code submitted 3 May 2024, paid 13 June 2024:

-

Hi. Please could somebody share the cost estimation spreadsheet. We are embarking on our self journey (remodel/rebuild) and I want to cost both option so that I am clear as to what can be achieved. Has anyone been to QS. Are they worth the money? The issue is they would need plans and plans would cost money and two option would cost more moneys so I want to see first I can pull of total rebuild, if not I will go down the remodel route. Would really appreciate any help you guys can provide. Thanks.

-

Looking for some advice, Currently about to sell our house and move to rented accommodation. We are using the equity from our house sale to purchase the land and then apply for a mortgage to do the build. When should we apply for the mortgage? We will be starting planning and building warrant process next week. Do we wait untill we have planning/warrant in place?

-

Background – I live in a 3 bedroom bungalow which was built in the 1960’s I moved in over 4 years ago and we have planning permission approved in Feb 2019 to convert this into a 4 bedroom house (this is the last bungalow on the street all others have been converted) With my mother-in-law falling terminally ill and a large proportion of our funds going towards making her what was her final year more comfortable, construction has just been pushed aside. As Covid has started to subside somewhat my wife and I (and newborn son) have started to pick this up and explore our options. I am looking for advise as Im unsure on where to start and im getting/reading conflicting information. Issues: · We have a 90m extension approved (45m2 downstairs and 45m2 created upstairs) the house is passed its sell by date – its in good condition build building old with new is concern. · Foundations are non-existent, but we have designed the property so that we would only need to underpin 5m on one wall. · Our funds are only half 90k of which I know this is half of what I would need. My wife has stopped working to look after our son too. – I have 2 years left on my 5 year fixed mortgage. · Planning permission expires in Feb 2022 I have had a couple of builders come and have a look at the house and they have commented that as we are having a complete new roof – gutting the whole house – side extension and rear extension then it would be easier to knock the whole house down and start from scratch. As I would save on the VAT and also a newbuild would be worth more, if a apply for a replacement dwelling I would also have another 3 years on the planning permission. For the funding side we will just board out the top living space for now until we have the funds to complete this and focus on the ground floor. I could just spend the 90k on renovating the whole of the bungalow but with the location I live in and the plot of land the house sits on this would be a wasted opportunity and Im determined to make this into something amazing for us to live in and also financial gain. If anyone can give any advise on what I should do, I have attached some of the drawings from our architect and structural engineer. I feel my options are as follows. Continue on the same path, start groundworks and the extensions despite not having all the funds and building old with new ( this is too risky in my eyes) apply for a replacement dwelling and redesign new plans (something more space efficient and cost effective to build) Knock my current house down and start a newbuild with he current plans from scratch with a budget of 90k and (2k a month from income) Do a considerably smaller extension (10m2) gut the whole house and regret not being able to maximise the full potential of the site? I welcome your comments and feedback and really appreciate you taking the time to read my post. Thank you. 01_Existing_Proposed_.pdf 03 _Proposed Driveway Plan Rev A.pdf

- 4 replies

-

- bungalow to house

- newbee

-

(and 3 more)

Tagged with:

-

I'm trying to understand the economics of a self build better and want to understand how to better predict £/m2 pricing. Obviously the complexity, design features, material choices will have an immense impact on price but for the sake of this arguments let me simplify it to a cost for a watertight shell (finished render exterior & doors and windows). What would be more expensive: A 200m2 single storey house or A 200m2 1.75 storey dwelling with a ground floor area of 100m2. To me the answer is obvious the first will be more expensive due to the larger foundations roof etc. However, by how much? I am looking at a plot that has planning permission for a rectangular 4 bed 1.75 dwelling (200m2 roughly) and I'm straggling to understand how to price it correctly per m2. Location: outside Edinburgh by-pass, preferred construction method: ICF. I've budgeted about £110 - 130k so far for a water tight shell with me working PM'ing a contractor to reach that stage but maybe i'm day dreaming.

-

Hey Everyone, I am looking into self build funding and see Ecology mentioned on this forum quite a lot. Few questions: - When Ecology grant a mortgage, do you have a monthly payment up front, or do they class this as a development type finance and roll it into the exit? - I am assuming you only pay interest on the drawn down funds, rather than interest on for example a 500k mortgage up front? - Would they take first charge over an existing property as part of the mortgage process or just provide the additional funds to build the new house as a 2nd charge Thanks Chris

- 6 replies

-

- self build mortgage

- funding

-

(and 2 more)

Tagged with:

-

Funding a Self Build after maxing out on Mortgage..?

Matt5100 posted a topic in Self Build Mortgages

Hello all, First Post!! My girlfriend and I have our properties on the market, with the mortgage in principle and our equity we are looking at a sum of £600k very max. with almost 50% deposit. I have found a beautiful 6 acre plot in a rural location. It has a basic structure (an old small barn) which is being used as present accommodation for the current owners and it has all utilities. I must emphasise this is very basic and small but could do for a year! The plot has PP and the footings are complete. I don’t fully agree with the house design that was submitted, but the foot print is suitable, it’s just the first floor we want to change. This is such a beautiful spot and I would love to grab it! However the plot is funnily enough £600k! I even have my doubts the bank will agree to this for the mortgage in principle. Does anyone have any experience with this? Also.. we need money to build the house, maybe another 350k… I am in no doubt that once complete, with properties to compare with in the area, we would be looking at a final property of between 1.5 - 2 million. This is for our forever home though and we are not looking to profit from the development. How on earth can we source the additional funding? Parents can’t help, are there some sorts of loans instead of a mortgage that would allow for the final build and then…?! I have no experience at this! I have a reasonable salary and my GF has an ok salary, the amount we could borrow with mortgage in principle was the most for our salaries combined. I have about £70k in shares, but am not willing to sell due to the hammering they have had this year, if I wait a couple of years I’m hoping they will be double if not more once they have recovered. So my shares are a no go at the moment. We just have no more equity.. Is it possible, or are we dreaming?- 6 replies

-

- self build

- mortgage

-

(and 2 more)

Tagged with:

-

Just thought I'd post it there for all those planning their finances for the self-build. We've got our Accelerator SB mortgage via Buildloan (who've been very helpful throughout), successfully received the initial drawdown to repay previous mortgage on our bungalow, and then promptly in due course applied for and drawn the next installment for foundations. All was going jolly well, and now time has come to request the next drawdown, per our agreed and approved schedule, to commense wall plate and structure. Buildloan did state that processing a request by the lender takes about a week, so we applied well in advance, and just sat there, so proud of ourselves. Five weeks on, still no drawdown issued. First they "lost" the survey report which was produced for this stage. Ok, found it in a few days. Then another week's silence, started chasing them, found out that they "suddenly" discovered that we cancelled the basement. OK, we brought up all the paperwork showing why, when and how we cancelled the basement, all the final iterations of plans, of costings, of approvals to confirm that this was all shown upfront and calculated BEFORE we even applied for the mortgage. Another week of silence, apparently lots of to-and-fro-ing between the Lender and their surveyor, finally it seems they managed to read the docs and confirmed they are happy that there is no basement. Great. Another few days wait - now it seems no one can establish from three sets of plans they've got (planning permission plans, SE plans and buid regs) what is the GEA of the house plus garage. Not obvious from plans. And no one can tell us, whose job it is to bloody look at plans with a calculator, read the numbers and get the GEA. It's between the Lender and the Surveyor. In the meantime we keep waiting (nailbiting taken to a pro level), it's been 6 weeks now (instead of 5 days). Cannot talk to the surveyor directly (they are employed by Lender so refuse to talk to us), cannot talk to the Lender directly, our only channel is the Stage Release team at Buildloan who are really very sweet (never answer the phone but to respond in writing to voicemails every couple of days), but it seems there is not much they can do, they're just a messenger. Luckily we managed to negotiate the very first drawdown to be quite significant, and together with the 2nd one and our savings it has lasted us so far, but the whole situation does not really help a healthy cashflow. All the above - as a warning to those planning their stage finance: it may all look great on paper, but our Accelerator product turned out to be a massive arrears one. Plan for contingency and have a massive cash cushion for cases like this. (we ask for your prayers this Christmas time so that someone somewhere between London, Bornmouth and Newcastle finally looks in the right place on the plans, and presses the right button)...

.jpg.c21f3ac78c9b7efd90cbdcb312744dc5.thumb.jpg.7adcad4c0e384f5ecd7d56b0618df6e5.jpg)