Jimbo37

Members-

Posts

165 -

Joined

-

Last visited

Personal Information

-

Location

BT33, N Ireland

Recent Profile Visitors

6524 profile views

Jimbo37's Achievements

Regular Member (4/5)

14

Reputation

-

Asbestos disposal VAT

Jimbo37 replied to Jimbo37's topic in Self Build VAT, Community Infrastructure Levy (CIL), S106 & Tax

Thanks @Conor -

Hi To my knowledge, things like overalls and masks etc are not VAT DIY reclaimable, in the regular circumstance - can these things be claimed, if they are single use, eg disposable overalls for asbestos removal? Also, can you claim for stuff you did before the PP was granted - e.g. securing the site outlays, fence etc? TIA

-

Thanks @joe90

- 3 replies

-

- settlement cracks

- paint

-

(and 1 more)

Tagged with:

-

Anyone, please?

- 3 replies

-

- settlement cracks

- paint

-

(and 1 more)

Tagged with:

-

Hi all, a bit of a steer, please I had a block cavity house built by a contractor who did everything up to, plastering (ie excluding kitchen, painting and other latter jobs) and I'm in since June. Generally all is good, thankfully, but I do have a lot of minor cracks that mainly appear around windows and doors, strecting out to floor or ceiling. I have it on good advice that there are minor, basically drying out and settlement cracks - so I am not worried - and to drop back after 12/18 months to fill and paint them. My question - is that up to me to do, the builder or the painter (thats me anyhow)? Thanks, James

- 3 replies

-

- settlement cracks

- paint

-

(and 1 more)

Tagged with:

-

Hi BuildHub'rs I'm in the latter stages of a 2 story build with a joist and osb first floor. I have installed hushpanel 28 floating soundproof on top of osb, which seems very good. Problem is, my flue comes up internally from main living space through corner of master bedroom through 400x400mm hole with heat ventillation grill, bypassing the soundproof. All is not lost, as I can box in flue in upper floor. What product/ board should I use for good acoustic performance, please?

-

- 4 replies

-

- window cills

- window sills

-

(and 1 more)

Tagged with:

-

Thanks @Mr Punter - should I have expected the DPC to have prevented my inner cills getting, before the mastic was increased?

- 4 replies

-

- window cills

- window sills

-

(and 1 more)

Tagged with:

-

Hi Self Builders I need a steer, please I have a new built masonry house, with a cavity and standard DPC window details. I had wet patches low down on the internal reveal - a wet quadrant from junction of window cill and window frame. The builder resolved it with additional mastic around the frame on the outside, and it seems dry now. My questions are - shouldn't the DPC have directed the wet out, before it got to inner leaf? - is mastic in this case a robust solution, or will it need replaced, maybe every 5 years?

- 4 replies

-

- window cills

- window sills

-

(and 1 more)

Tagged with:

-

@ADLIan Just passed this to my architect, as I was concerned that my insulated upstands were not insulated at the top. She didnt understand the reasoning (this edge of the insulation is facing up/cold) - do you have any references or further comment you can give. TIA

-

Oh dear! Can the flue squeeze in here?

Jimbo37 replied to Jimbo37's topic in Stoves, Fires & Fireplaces

Mmh, the flue guy installed this using lead flashing and loosely packed insulation wool, but there is condensation falling from bottom of lead. Anyone got a good understanding of how the detail should be (warm roof, insulated box) - I'm guessing solid insulation with vapour control, maybe? Also, that collar is siliconed - is that OK? Im a tiny bit nervous that the lead does not stretch down far enough. Ooh, I have to stop looking!!- 25 replies

-

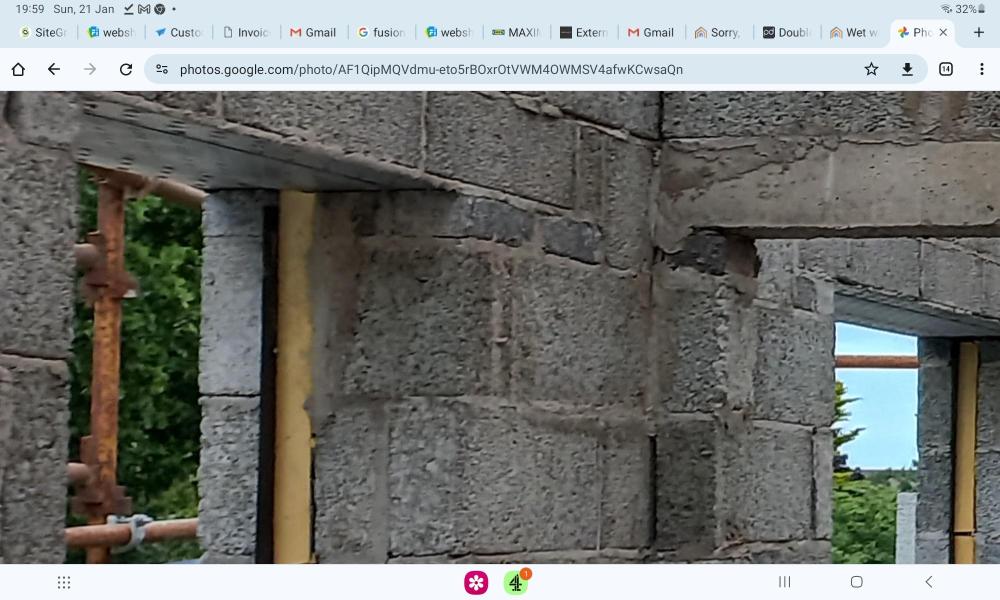

@Andehh see pics above, and this one which was taken for unrelated issue (unprotected timbers) but shows head stepped dpc

-

Ive spent a bit of time studying these today 1 - I noticed that there are weep hole covers missing, could that be the source? 2 - I see cills run under frame from outside to inside, could water be getting blown back through? 3 - Mastic is good, but not perfect everywhere (could this be the cause, or is this really essential to weather proofing)

-

I'll look for pics, but it looked right. Step dpc in head, and strip of dpc from inner leaf down outer leg of frames Edit: see 1 pic up. Unfortunately I don't have much better pic