Mania

Members-

Posts

51 -

Joined

-

Last visited

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

Mania's Achievements

Member (3/5)

18

Reputation

-

Thank you all for your guidance. I am not anxious about our permission lapsing and evidencing anymore. So, I spoke to the building inspector at our LA for guidance as to what they would do. He said they don't usually notify on commencement and advised me to check with the Planning Officer. I decided to email him to notify him of commencement and I received a response saying noted and there is no requirement to notify. I am happy to have a time and date stamp against that. The building inspectors site visit report also has purpose of visit "commencement" plastered on it. Now I am comfortable that officials have acknowledged and documented our start.... @saveasteading your advice was sound - thank you.

-

Thank you @saveasteading We have fulfilled each one of the items on the checklist above and were sure to take plenty of photos and videos of the works carried out to keep as evidence. (For anyone's (in the same position in the future benefit for reference)) after full payment settlement our BCO reviewed all of our structural engineer's, architect's plans & made us get an Energy Compliance report etc. and signed off all that as okay to commence prior to their first site visit to validate. That's a good idea to email them all to someone. Our appointed Building Inspector took many photos too - they have offered to send me their notes for the site visit, I expect that they will make reference to commencement and eagerly await those.

-

Thank you @kandgmitchell Our builder did run the length of pipe from soakaway in a trench right up to the location of the proposed foundations which seems to be in line with yours and Building Inspector's advice. The LA building control team have referred me back to our planning officer who dealt with our case - I can't get through by phone at the moment, when I do hopefully he will give me some sound advice on how to get rid of this headache easily 🤞 I'll ask about discharging the 1st condition and also about the certificate of lawfulness. I like to think that the LA would be accommodating and want to be onside. It wouldn't be good for anyone if we demolished our home and left it for years until we're in a position ready to build. In this current financial climate it's likely to take us at least 2-3 years. This is the Condition: Conditions: 1 The development hereby permitted shall be begun before the expiration of three years from the date of this permission. Reason: To comply with the requirements of Section 91 of the Town and Country Planning Act 1990 (as amended).

-

Thank you all. @Temp I’ll follow your advice & see where I get to. I’ll post updates here to confirm if I got a “proper” acknowledgment from our LA. You’re right - it is our first condition. I’ll ask the rep to confirm what he needs from us to discharge. We’ve discharged all of our conditions in the document. Apart from Third Party Wall Agreements & I think we’re good to go (when our finances fall into place). Thank you

-

Hi I hope you can help please. Our planning permission is due to expire early next year, so I have been keen to make sure that our permission doesn't lapse. With agreement and advice from our inspector our builder dug a soak away and trench and laid a length of pipe. The Building Inspector was satisfied with commencement of works and has signed off. I have asked the BI to send me written confirmation of the site visit. Here comes the tricky part (for me anyway, as I desperately need some comfort). I am seeking confirmation from our Local Authority and the representative there keeps acknowledging and referring to the "initial notice" letter from the Building Inspector advising that they will be acting for us and the LPA has also provided me a copy of their acknowledgement back to the inspector in return, as well as advising me, "Once works are complete they will send us a copy of the final certificate". I might call the LPA representative tomorrow as I feel like I am going in circles to get explicit advice re commencement acknowledgement from them via email. Do the LPA not need a formal notification to confirm that work has commenced, it seems strange to me that they don't? Or Is it just something that the Independent Building Inspector keeps a note of and we are covered, should I relax and stand down? I just don't want to face any issues when we properly start demolition and building in a year or so. Many thanks in advance for your advice. PS Probably irrelevant but we do have our Section 80 & 81 in place. We can't afford to build in the current climate and likely to go beyond the expiry date.

-

Hi Nod I'm not aware of planning in principle. We are in a situation where we have fully planning permission and want to "commence" to prevent our planning application from expiring in less than a year. Our building inspector advised to "lay a length of drain" and suggested "a min of 3m to a connection", following this they will come to inspect and sign off as commenced. Would anyone know if there's a standard depth that this length of drain needs to be or does it depend and vary from one site to another? Thank you. Our builder (won't be doing the main build) is messing about saying its going to rain for two weeks and I have started wondering if we can/ should just get the Kango out.

-

Hi @JAS-Build

-

What constitutes as build commencement

Mania replied to MikeGrahamT21's topic in Planning Permission

No problem @MikeGrahamT21 Thank you for responding. I hope you feel better soon. I'll do some digging around 😉 -

What constitutes as build commencement

Mania replied to MikeGrahamT21's topic in Planning Permission

thank you @Temp -

What constitutes as build commencement

Mania replied to MikeGrahamT21's topic in Planning Permission

HI Mike How did you get on? What did you have to do? We are in a similar situation wanting to get commencement signed off / acknowledged by the council. -

Hi JAS-Build or anyone else who can advise please. Did you exercise "commencement"? We have discharged all of our conditions, our LA doesn't apply CIL and I also have the demolition notice. With material prices being so high at present and our need to gather more funds to build we are keen to get commencement signed off to keep our planning application active to buy more time. I've been advised, "Technically digging a trench for foundations or starting demolition would qualify as commencement. it is a good idea to put some concrete in (making sure that you will use it in the final house) and you MUST have secured approved of any conditions that have to be satisfied before development commences if this is to be a legitimate start". Do I need to appoint a building inspector to review our construction plans first, is it their job to inform the council of commencement? Our Structural Engineer advised that building inspectors prefer to be engaged nearer to the time of the actual build so that they can work out their timings to visit site etc. but we aren't ready for that yet. Do you have to write to the council prior to the intention to commence or do you write to them after you have "commenced"? Then does the council acknowledge as actioned to trigger the approved plans and extinguish the "3 year from approval decision" expiry date? Thank you.

-

Hi Matthyde83 When you mention service connections do you include others apart from gas & electricity? And sorry for being a bit thick, does that mean the meters too? Our site has to be cleared for piling so keeping the existing garage for housing would not be an option for us. Would we need to choose where on our drive we want those services to be from where the builders connect? What will they "live" in? Thank you.

-

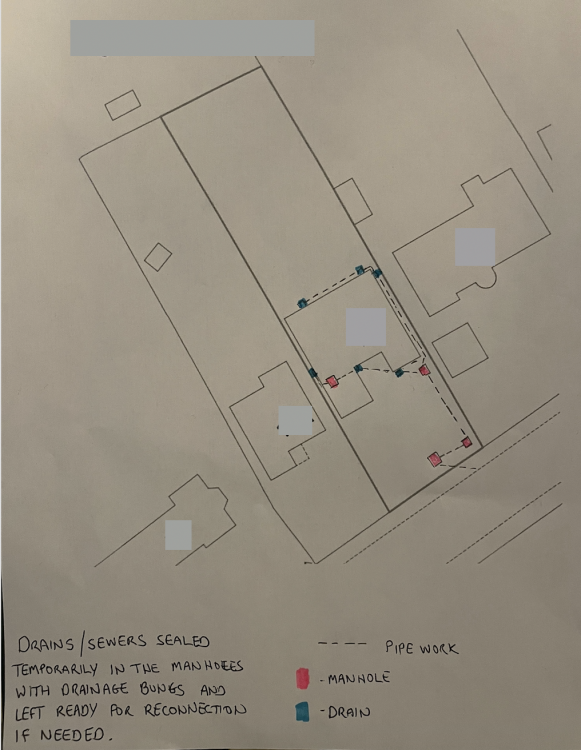

Hi Thank you all for your help. After serving our Section 80 notice we received the counter Section 81 notice within a week. To help others I attach a sample of what we submitted:

-

Hi Matthyde83, Yes, you need to file a section 80, then the local authority will provide a counter notice for you to proceed and if you don’t hear back at 6 weeks you can start. https://www.legislation.gov.uk/ukpga/1984/55/section/80 I emailed our local authority’s building control team who sent me a basic form. Have you sorted out your party wall agreements (if applicable) before you start your build and checked if CIL is due? Good luck ?. We plan to demolish our bungalow and replace with a 5 bed detached too. Although we are likely to early next year. Exciting times!