-

Posts

18 -

Joined

-

Last visited

Personal Information

-

Location

Bristol

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

AjitSingh213's Achievements

Member (3/5)

0

Reputation

-

Thanks @Kelvin I agree, we were aware about groundworks being unknown and are hoping that the ground investigation has given us a good idea of what is underground although understand we may still dig something up. Understood re. price, will stay optimistic that some of the smaller local groundworkers can give us a more appealing price. What foundation system did you use for your build by the way out of interest? Thanks @saveasteading I will keep this in mind and speak to groundworkers about any value engineering that might be available. Our retaining wall is a cantilevered solid concrete wall for example but it isn't that high so have had some indications that there may be other options, along with alternative options for the foundation such as beam and block as opposed to insulated raft passive slab which may be more cost effective? But unclear on whether it will be as I understand that it is dependent on ground conditions? As far as I am aware, the ground investigation company said that the ground conditions were relatively good so hoping that there might be other avenues that we can take.

-

Hi All, Thank you so much for your responses, as you can imagine, extremely stressful time for us, which we expected with self building but maybe not so much before we had even started on site? Trying to remain positive about this and looking for a solution. @Kelvin We have approached some other groundworkers who are more local, the ones that quoted were about 1.5 hrs away and seem like a large outfit with high set up costs so hopefully a smaller groundworker will charge less. Good to know re. your costs, at this stage we would even be acceptable to paying £100k for the groundworks package. @saveasteading Thanks for the advice, we have gone to 1 who is doing the groundworks right next door for another self builder so he is familiar with the site, hopefully that helps. Another who is an old friend and another who we know through a mutual contact - all local, I will see what they come back with and yes, we will provide them with the SE designs. We received them this morning so have sent that all across to them including all of the surveys we have had done. @nod Agreed, as stated, we have the designs now, personally I can't make heads or tails of whether it is going to be that expensive or not, would it be helpful to post some images of what has been designed here? Or is it just worth waiting for groundworkers to come back with more quotes and then see what they say. Whilst we are digging down, and we agree and accept that will come at an extra cost, we just didnt think it would be that much. Again, appreciate the responses Thanks

-

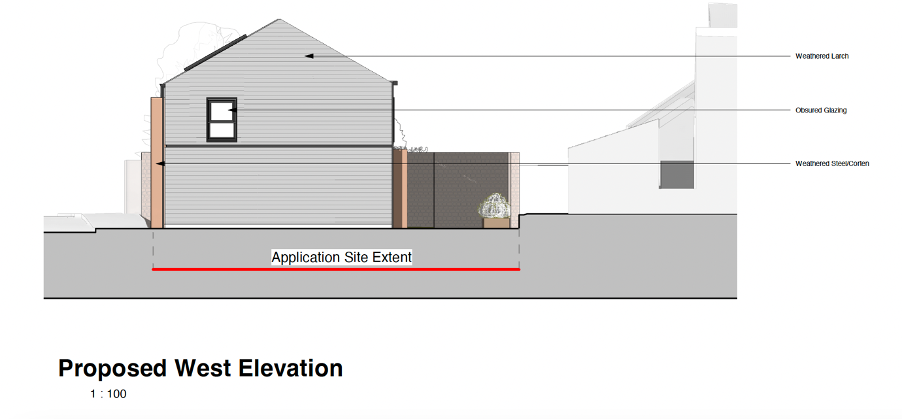

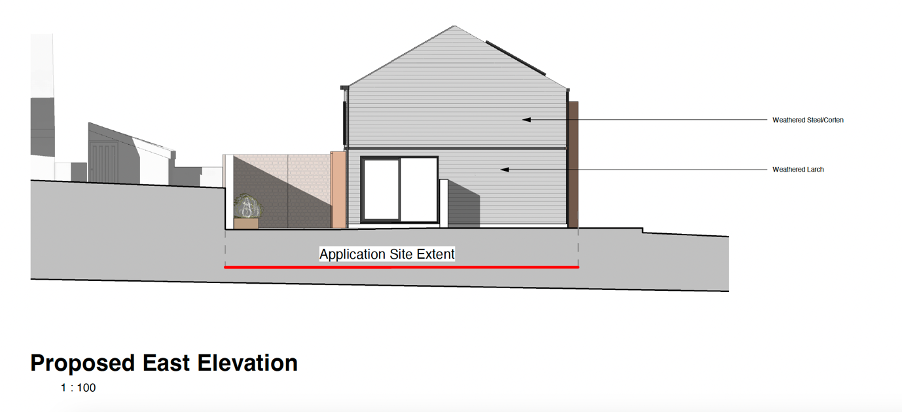

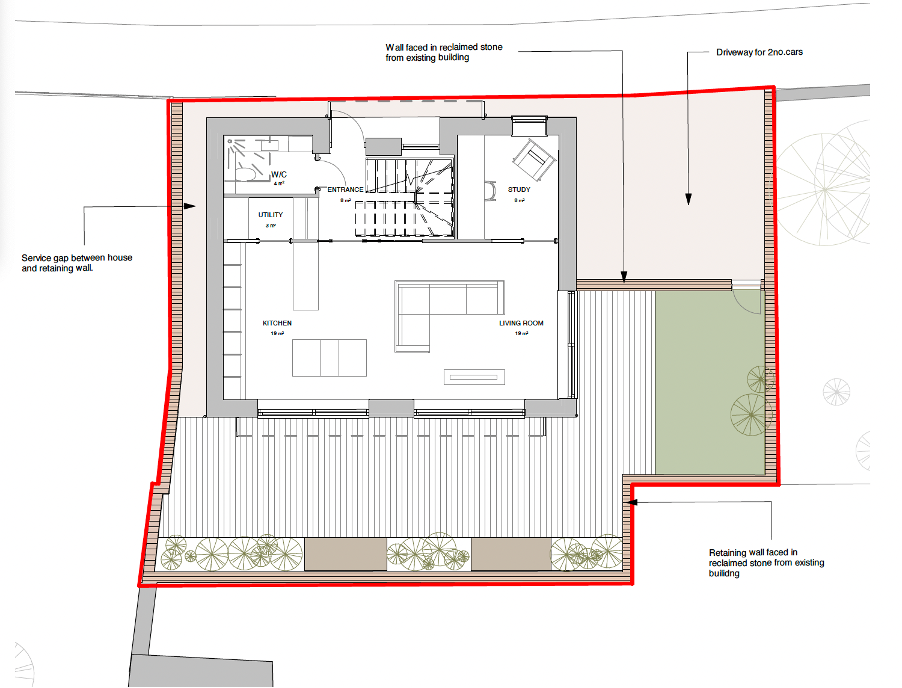

Hi All, I am a self-builder and I need help! Short story is: I have planning, got a self-build mortgage in place (only drawn down money to buy the land so far), was working with a turnkey house provider to build a Timber SIPs home (tight ish site), they were going to do from planning to giving us the key, they did the SE for groundworks (insulated concrete raft slab - passive), drainage/services and retaining wall and got quotes for groundworks which were way higher than expected so we are parting ways (along with several other reasons) with them so we can be more flexible on costs and take on some more stuff ourselves (we are nervous about this!). The question I have is what a reasonable ball park cost for groundworks, demolition (2 small single story barns), site clearance and securing the site, foundation, drainage/utilities and retaining wall might be? For my work I was quoted £175k and I am finding it hard to believe that this is reasonable for the size of our plot (120sqm GIA – 10m x 8m footprint, 80sqm garden space) - maybe it is but from indicatively speaking to people in the trade, they don't seem to think so? I have full planning drawings, in a residential area so utilities is close by, it is on a slight slope and we are digging down to get a 2 storey house in (planning requirement), retaining wall is on average less than 1m high most of the way round the boundary (30m in length). I don't have the SE drawings yet, we are going to pay for those as part of our termination and will receive them shortly (previous company used them to get the quote), ground investigation done with no major concerns on ground conditions. We are currently exploring using a different builder all together for the house and have had estimates already for groundworks which are significantly less (although they do not have the structural engineering or drainage design so we understand this could change massively although their estimates are based on their SE reviewing the plans and coming up with an estimated price). We understand that there are a lot of variables, we understand we don’t know what we might dig up and we know that no site is the same but we are just trying to understand 1) Whether anybody has had similar experience to us and if so, what action did you take? 2) Whether anybody has any general advice on what the best next steps are and any thoughts on the price provided? 3) Whether anybody can share their groundworks costs so I can make rough comparisons or express their opinions on the price quoted? Any help would be greatly appreciated! Some images and sections of the site and house plans are below Thanks in advance

-

Help to Build launched today - is it worth it?

AjitSingh213 replied to AjitSingh213's topic in Self Build Mortgages

Hi @MikeSharp01thanks for your reply! So, you would go through your standard mortgage process through Buildstore for example, build the house and then get the help to build which pays off the 20% for example, leaving your deposit as 5% which then brings the monthly payments down? What do you think about it?- 6 replies

-

- mortgage

- self build mortgage

-

(and 1 more)

Tagged with:

-

Help to Build launched today - is it worth it?

AjitSingh213 replied to AjitSingh213's topic in Self Build Mortgages

@SteamyTeaI think if there is a drop in house prices, then the government would pick that up, but find it unlikely that the amount you have to pay back will go below what you borrowed. Just doesn't make a lot of sense to me but trying to see if there are any major benefits which I am missing!- 6 replies

-

- mortgage

- self build mortgage

-

(and 1 more)

Tagged with:

-

Hi All, The Help to Build equity loan scheme launched today with Darlington BS being the first lender to offer it. Does anyone else see any benefit in doing it because it is linked to the value of the house not how much you borrow? The help to buy was structured similarly and has been reported as a 'nice little earner' for the government because house prices have been going up. I understand that there are benefits in terms of being able to put a 5% deposit down and not pay interest for 5 years but long term I see the help to build as being even worse than help to buy? I think it is the reason for it being worse is because self builders create value by building a house. Even one of the examples in the guide it shows that you borrow £70k and on day 1 you have to pay £100k back because on day 1 once the house has been built it is worth significantly more than the cost. Then over time, as the house value goes up, that £100k that you have to pay back goes up in line with the value of the house. Granted the scheme works in the same way if house prices go down but the trend for house prices over the last 50 yrs is that they have gone up, quite significantly in recent times. Does anyone else have any similar views? Thanks!

- 6 replies

-

- mortgage

- self build mortgage

-

(and 1 more)

Tagged with:

-

Government Help to Build Equity Loan

AjitSingh213 replied to jen and mark's topic in Self Build Mortgages

Agree with everyone here. Understand there are some benefits, but I am not sure why anyone would go for this help to build scheme as you will, in most circumstances be creating value and so the loan increases in line with that value? Linking it to value just means you pay back a chunk more plus the interest and repayments from y5 onwards. -

AjitSingh213 changed their profile photo

-

New Member - Embarking on Self Build in Bristol

AjitSingh213 replied to AjitSingh213's topic in Introduce Yourself

Cool, not long to go, that would be amazing! Should I drop you a PM to organise? Or a text or email? -

New Member - Embarking on Self Build in Bristol

AjitSingh213 replied to AjitSingh213's topic in Introduce Yourself

@PeterStarck Thank you! @willbish Hi! Interesting, how far are you through your project? -

New Member - Embarking on Self Build in Bristol

AjitSingh213 replied to AjitSingh213's topic in Introduce Yourself

Thanks! -

Hi All! Just signed up to BuildHub as we are in the early phases of our self build project and thought it would be good to talk to other self builders and join the community. To provide a bit of context I am looking to do a self-build with my partner, we are both living at home with my parents to save up enough money which we have now, but we are both first time buyers. We are looking to build a flat pack/kit home and are currently searching for land in Bristol. We have identified plots of land and have had them assessed at a high level by the kit house companies, planning consultants and architects (and carried out our own assessments) to ascertain whether the plot is feasible to build on. We have just sent letters to the land owners expressing our interest in purchasing so fingers crossed someone comes back saying they are interested in selling! They are mainly large garden plots. The main thing that we are probably looking for support, advice and guidance on, is searching for and securing land, so if anyone has some tips and tricks, please get in touch! Thanks Ajit