paulc313

Members-

Posts

33 -

Joined

-

Last visited

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

paulc313's Achievements

Member (3/5)

0

Reputation

-

Hello, My father in law has installed all the pipework for out MVHR system and all we need is the unit itself, either a Q350 or Q500. We've had it on order for around 6months but are now being told it's not going to be here till September 2022! Does anyone know of places that might have them or alternatives? He is of the opinion that other makes can't be used. Thanks Paul

-

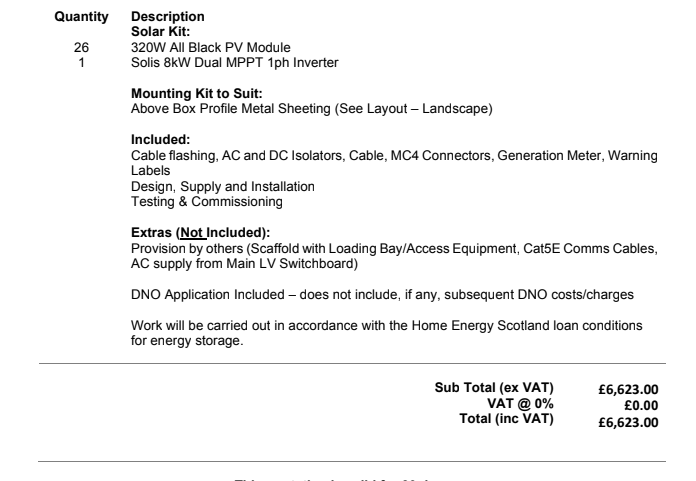

@ProDave So we have too many panels and too much electricity being generated?? Even with a south west direction and ASHP?

-

Sorry I know this has been done to death and the same questions have appeared in this forum but I thought I would ask anyway. I like the idea of PV panels, however after reading through this it appears that many people have said that if quotes are high - 4k - 6k PV it is not worth it financially. I'm about to do my loan application for renewables, getting an ASHP and potentially PV panels. We were thinking of putting them on our workshop roof which is much bigger than our new build. This is the quote I got: The workshop is in Aberdeenshire and faces directly south west. There are four of us in total and due to our circumstances it's likely that there will be one of us working from home every day during the week, most probably 2days both of us working from home. So could potentially get dishwasher/washing machine on etc mid day. Plus we will be using laptops/monitors/tv's on during the day as well. So I was wondering if you could tell me if it is financially worth it? How long will it take roughly to pay the sum back from savings? Thanks Paul

-

Evening, I have a small 'shelf' area in blue in the picture which sits above our front door and between the front door and the two veluxes in red. The void in black is where our staircase is going. Does anyone have any ideas for this space in blue? We can't box it up because of the velux's and can't actually access it as a space you could walk in. So our only idea was to turn it into a shelf and put something on it. Thanks Paul

-

What variation of white - Krend?

paulc313 replied to canalsiderenovation's topic in Plastering & Rendering

-

Can anyone recommend any good businesses that deal in stone panel cladding that will send samples out? Thanks Paul

-

I've checked out DIY kitchens and they don't have the handle-less shaker style I require.

-

Has anyone looked into this supplier or bought a kitchen from Masterclass? They appear online and are marketed as 'affordable' high end kitchens.

-

Hi, My wife and I are at a point in our build that we need to start thinking about lighting design. To be honest we both don't have a clue. Would anyone have any good websites or guidance on where to start? What's new in the lighting world? Any recommendations based on experience of your own builds? Thanks Paul

-

Hello, I personally don't know anything about underfloor heating. It's my father in law installing the system. However, he's asked if we want the all singing all dancing system where you have an app on your phone rather than thermostats throughout the house to control it. It costs a bit more so not sure at all whether it's worth the extra cost. We will have a ASHP so I assumed I would just be running the heating throughout the new build house at 21 degrees all the time so no need for an app. Can anyone give some advice on if it's worth it? Thanks Paul

-

Heat loss from pump to storage cylinder

paulc313 replied to paulc313's topic in Air Source Heat Pumps (ASHP)

@ProDave Not overthinking this, it is a real and genuine problem. The airbnb my mum and dad have just lived in was built in 2016 with the ASHP sitting around 2 metres away from the ground floor windows and around 3-5metres from the 1st floor bedroom windows. You could hear it ticking over during the night with the windows closed. It wasn't loud but just an annoying noise when your trying to get to sleep. Re your point about the noise from oil fired boiler, I wouldn't put up with that either or even a gas boiler's pump. -

Afternoon Everyone, We are going to purchase a ASHP for our self build. I have reservations about the noise from the pumps ( I work in Environmental Health and deal with noise complaint from them). Also my mum and dad just visited, staying in an Airbnb which had one and the you could hear it ticking over during the night which would really annoy me. I think I've found an alternative position that would make it inaudible but it is 25 metres away next to my father in laws workshop. We will be running a cable anyway from the workshop as were putting PV on the workshops roof to top up the hot water. I just wondered what the heat loss will be like with a 25 metre pipe that's well insulated, could anyone calculate this or know what it would be? Thanks Paul

-

@joe90 @ProDave Thanks. I've had a quote from a contractor who said the following for our house (it's a 5 bed 250m2 detached house): We would suggest this system is spilt into 2 smaller air source heat pumps. Downstairs designed with a flow of 35degree and the upstairs radiators with a flow design of 45degree connected to a 500litre thermal store to give the highest efficiency use of the hot water. Are they trying to get more money out of me by recommending two ASHP system or would this be a good way of doing it?

-

@ProDave Ok thanks, I'm just looking at all the options just now. I'm a bit of a noob when it comes to these things. What happens when you may have guests round and multiple people taking showers one after the other? I take all the water in the tank gets used up and you'll have to wait a couple of hours for it to heat up again?

-

@ProDave It's for a new build. I suppose it's anxiety about using a new technology that we've never used before so want peace of mind that if something goes wrong at least the oil will be a back up.