bluebellcottage

Members-

Posts

18 -

Joined

-

Last visited

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

bluebellcottage's Achievements

Member (3/5)

2

Reputation

-

Galvanised gutter with timber cladding

bluebellcottage replied to bluebellcottage's topic in Rainwater, Guttering & SuDS

@saveasteading Lindab is my favoured brand due to the look, I prefer some of the little details over other brands. i have also looked at Galeco and Zambelli. originally i was looking at galvanised but one of the other manufacturers suggested using powdercoated in a suitable colour would be an option if I really wanted steel gutters. -

Galvanised gutter with timber cladding

bluebellcottage replied to bluebellcottage's topic in Rainwater, Guttering & SuDS

@Benpointer from my research I believe you are correct and the tannic acid in the timber would/could damage the zinc via water runoff. What I don’t know is if this would happen over a period of a few months, years or over many years in which case it may not matter. -

Galvanised gutter with timber cladding

bluebellcottage replied to bluebellcottage's topic in Rainwater, Guttering & SuDS

Hello, thank you for the input. I should have been more specific about the type of gutters. I am using standard gutters fixed to facia brackets. These will be on the pitched roof dormers as well as the main gutters at the eaves. The facia boards are already fixed and are western red cedar. Each dormer cheek (5 dormers, so 10 in total) has a surface area of approximately 0.8m2, I am yet to clad these along with the front and rear portions of the house so could possibly use an alternative here. my worries are. 1. Damage to the coating on the brackets where they touch the facia boards. 2. Damage to the gutters and downpipes from runoff from the dormer cheeks. it was suggested by one manufacturer that using a rubber gasket between the facia and bracket could help with point 1. down pipes will be fixed to brick using standard downpipes brackets. And spike brackets into the masonry behind the cladding where over cladding (this is due to the cladding being set 30mm back from the face of the brickwork and the facia boards. -

Galvanised gutter with timber cladding

bluebellcottage posted a topic in Rainwater, Guttering & SuDS

We have galvanised steel guttering specified on our plans with western red cedar cladding. I have been advised that this isn’t a good idea as the tannic acid in the timber will damage the galvanised coating on the gutter. The same is apparently true of larch, oak, chestnut, douglas fir and cedar. I have contacted a few different guttering manufacturers and have been given similar but slightly differing advice. It seems the biggest issue will be that there will potentially be runoff from our dormer cheeks which will end up in the gutter. i have seen lots of pictures online that appear to show timber cladding with ganvanised gutters, some of which state the cladding used as being western red cedar and wondered if anyone has real world experience of this? another option to get a very similar look would be powder coated steel guttering which I have been told would be fine by one manufacturer and not by another. any help would be very much appreciated. -

Hello, I have a question regarding the flashing/wrapping of our dormers. I understand how a dormer should be flashed if it’s in the roof I.e lead corners and a lead apron however our dormers run in line with the wall on the house so I can’t see how this would work and can’t find another detail for it. Currently I have run the soakers right down to the bottom of the slates with a view to cutting them down so that water doesn’t run off the side of the roof. I understand this is probably wrong but it seemed like a good idea at the time. The pen line marks where I had planned to cut the soakers (or possibly a little lower) any advice would be very much appreciated.

-

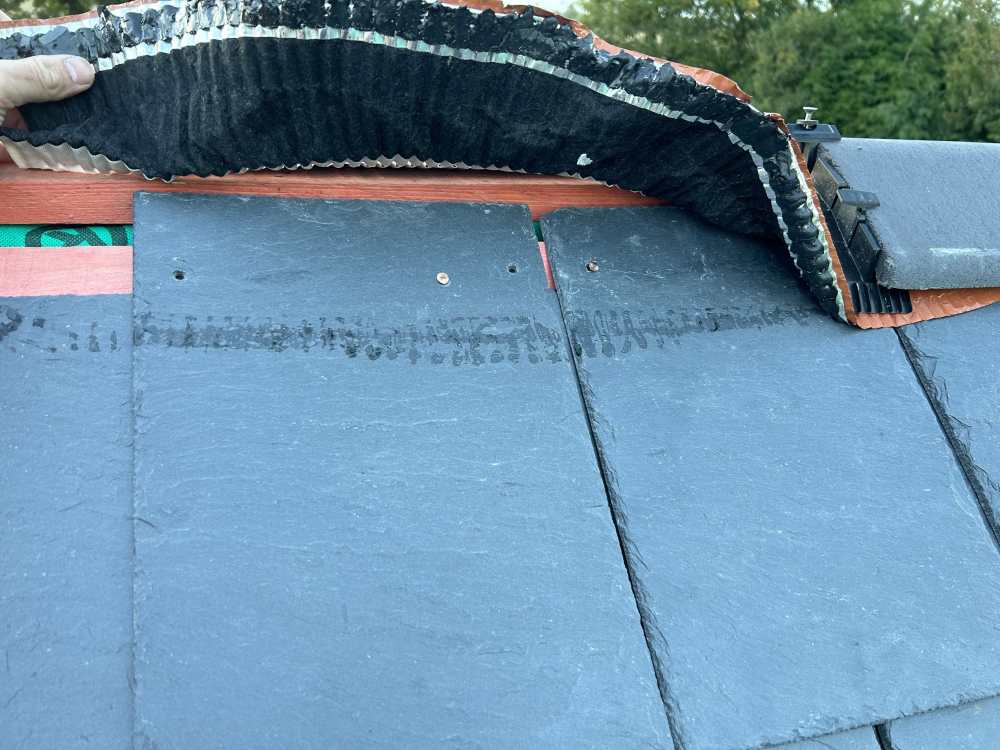

I have finally made it to the ridge on my roof and have a couple of questions regarding the top slate. please ignore the rough nature of the slating and mismatched ridge roll, these were my reject slates and only fitted for mockup. Is this the correct way to fit the top slates in terms of the lap? The area where you can see the batten seems vulnerable but I can’t see a at around this. Using the dry ridge system leaves a small gap between the slate and the ridge tile, around 5-10mm. This is because the ridge tile has bottomed out on the ridge batten. I can’t really drop the ridge batten because it will leave a dip in the top of the ridge roll which I believe is not desirable as it can collect water. Adding a fillet under the top slate on the top batten improves the gap and makes the slate more stable as the slate now can’t rotate around the nails and lift the bottom edge. the only other way I could get around the ridge tile gap is to go and find some taller ridge tiles or drop my ridge batten down.

-

Slate and a half in valleys, advice needed.

bluebellcottage replied to bluebellcottage's topic in Roofing, Tiling & Slating

I’ve just had a look at these, they look like a great bit of kit and I’m sure they would save a lot of time over my hand cutters. -

Slate and a half in valleys, advice needed.

bluebellcottage replied to bluebellcottage's topic in Roofing, Tiling & Slating

That looks like a similar cutter to the one I have … it works very well. https://www.roofingmerchant.co.uk/product-page/edma-slate-cutter-with-punch?utm_source=google&utm_medium=wix_google_feed&utm_campaign=freelistings&gad_source=1&gbraid=0AAAAADh2aGz86ARgMDWSyV8Xo_T_LhvmA&gclid=EAIaIQobChMI6Iq-wZjgiAMVYWdBAh3VeDiGEAQYBiABEgJ6TvD_BwE -

Slate and a half in valleys, advice needed.

bluebellcottage replied to bluebellcottage's topic in Roofing, Tiling & Slating

@Gus Potter I should have made it clear in my post that I am the guilty party when it comes to the slaying of the valley. For various reasons I have ended up slating the roof myself and am generally fairly handy. I have however quickly become aware that l slating is an art and would have been best left to the professionals had this been an option. i have used a slate cutter for all the cuts so far and laid them riven edge up (with the exception of the under eaves course, this is the other way up) is this correct and what you refer to as the slates needing a tail in the valley? Thank you for any input. -

Slate and a half in valleys, advice needed.

bluebellcottage replied to bluebellcottage's topic in Roofing, Tiling & Slating

Thank you both for your advice. I think I’m possibly overly worried about the small triangle of slate being insecure. Will the slating that has already been done be ok as it is Or will I need to strip and re do this? The valleys currently have 65mm cover from the slates, they have a 25mm up stand which is why they look like there is a large gap where the lead is flat on the roof it’s wider than 65mm overlap as the lead roll is 450mm I followed a diagram forwarded from our architect for this but understand now that it’s possibly over complicated. Does this sound ok or am I setting myself up for a leaky roof? -

Slates and soakers at dormer cheeks

bluebellcottage replied to bluebellcottage's topic in Roofing, Tiling & Slating

Hi Nod, thank you for the reply, I would have made the soakers wider but had already cut them to size and I would have meant another trip to the builders merchant and holding my father in law up, he was also of the opinion that water doesn’t travel sideways normally. The pitch on our roof is 40 degrees and we have about 90mm of headlap so hopefully we should be ok. no I have to decide if I do the next side the same or use a slate and a half? -

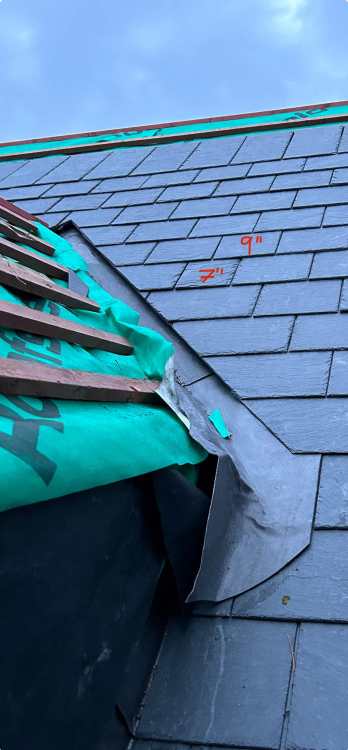

This week we have been skating in our roof, I have slated uptown and past the first dormer on the front and back of our house and am worried about the detail of the soakers and slates. i understand a slate and a half should have been used here but was persuaded to use a 9cm wide slither of slate instead, wind uplift probably isn’t a problem as it will be behind/below our cladding. i am basically worried water from the valley above will run off the soakers and down the side of the 9cm slates. i have included a photo for reference.

-

Hello, we are currently in the position where we need to purchase both a structural warranty and site insurance. I have had quotes from Protek along with some others. I would like to use Protek as their price was very competitive but just wondered about others experience with them, both their customer service and the situation with remortgaging once the build is complete without NHBC. our main builder isn’t NHBC registered and we will be completing as much work as possible ourselves so NHBC isn’t an option. Thanks in advance for any help.

-

Building regs and sign off one application or two?

bluebellcottage replied to bluebellcottage's topic in Building Regulations

Hi, thanks for the reply’s so far, location is North Norfolk, so would come under English rules. Building Control would be done through local authority as this is the builders preferred option and being a family member we trust his opinion. I did ask them and they basically just gave me two price options. builder’s advice is to dig footing and fill at the same time as the house. one mortgage adviser suggested it could cause a problem with sign off to remortgage. A building society I spoke to said there would likely be no problem as they had never experienced one in the past.