Mulberry View

Members-

Posts

692 -

Joined

-

Last visited

Mulberry View's Achievements

Regular Member (4/5)

112

Reputation

-

What to paint a Steel goalpost frame with?

Mulberry View posted a topic in RSJs, Lintels & Steelwork

I've got a (roughly) 2.5m Goal Post frame made from 100mm SHS. What's the best thing to paint it with? It's forming an Oriel Window opening, so it'll be covered/cladded etc, but I want to paint it properly before it's lifted into place. Historically I'd have used Hammerite or something like that, but I thought I'd ask you good folk. -

How to regain traction...

Mulberry View replied to Mulberry View's topic in General Self Build & DIY Discussion

I think you've taken the point I made about the pile of debris in the gutter a little too literally. This was just something that happened this week that highlighted just how fast that gutter can fill with modest rainfall. It is not the basis for my complaint. The Zinc contractor specified the size (350mm wide) and fall (1:60) for the box gutter, which was built by me whilst they worked on other parts of the roof, but VM Zinc contradict this, so who is right? It's a fairly big gutter with only one possible exit point at one end. It's a weird quirk in the design as there is a window very close to it which does influence things, but if the contractor had highlighted his concern, I could have helped to remedy it, as I am doing now anyway (well, I can't alter the roof, but I can make preparations for the remedial work from the point-of-view of the bits I control anyway). As for watertighting the upstands. I hadn't wanted to screw anything into the upstand and so have made sheeted strong timber frames that lay on top, I strapped them in from the inside. They are staying in place and the plastic is good stuff, but not sure how long it'll last. I am looking for a metal roof contractor to both report on the existing roof and help with a remedial solution/re-roof and would gratefully accept recommendations, but they'd have to be above average because I've had 2 local firms round so far and whilst they had some good info for me, I'm not sure either have the credentials to take this on. -

How to regain traction...

Mulberry View replied to Mulberry View's topic in General Self Build & DIY Discussion

The box gutter is pretty big. Its about 5m long, 350mm wide and has a 1:60 fall along its length. Its outlet is 200mm wide into a hopper. I happened to be on the roof yesterday for the first time since the Scaffolding came down at Christmas and noticed that there was a large amount of tree debris in the gutter, so I swept it to the end in readiness to remove it. It was raining at the time, and not particularly hard. I got briefly distracted, but in the hour or so I was gone, the 'dam' of debris had caused the gutter to fill almost up to the 100mm seam. VM Zinc themselves say that if the fall was 3°, then the upstand could be lower, but otherwise it needs to be 200mm. They ignored the photos and dimensions I sent to them and allowed the installer to reassure them that everything is compliant. It makes no sense. The area of roof I'm standing on to take this photo is about 100mm higher the adjacent upstand, yet only 350mm away. We had the roof windows here on site when the Zinc team arrived. They ignored the installation manual (which to be fair doesn't provide specific Zinc detailing) and I still have the Velux flashings in packaging in my site office because their 'solution' apparently wouldn't require them. Velux insist they have to be fitted. Sadly the movement action of the "top hung" window runs to a VERY tight tolerance and by allowing 4-5 layers of Zinc to exist between the upstand and hinges, will effectively move the whole window back by an amount that will probably cause it to foul the upstand as it is opened. I have a report written by a specialist installer organised by Velux that highlights this issue. The hinges pivot at the bottom, so this removes the ability for many of the 'fixes' that others have suggested, such as running zinc 'skirts' around them. I've had almost a year now of trying to crunch this in my brain to solve it. Velux told me I needed to provide at least of 100mm of net upstand height, I provided 145mm (theoretical), but stacked materials and general building 'sloppiness' have resulted in around 120mm in reality, so 25mm was lost somewhere during the installation. The Zinc installers proposed workaround would result in 60mm from the roof deck to the first ingress point, VM Zinc expressly say that's not enough. I say that I do not accept they'll be able to achieve their proposed design at guarantee 60mm, it's far too technical and if the end result is 50mm or even 40mm, then it makes the situation worse. Even the fixed window is a problem because the Window itself lays onto the upstand and 'drapes' over the edges. By design, it is then screwed to the upstand and these screws will penetrate the Zinc and prevent the expansion movement it needs. The screw holes will only be about 50mm off the roof deck because the overall upstand height doesn't meet the dimensions shown here, again due to the stacked materials and weak adherence to tolerances. -

How to regain traction...

Mulberry View replied to Mulberry View's topic in General Self Build & DIY Discussion

The roof, for better or worse, is mostly finished. Sub-standard, but finished. There are no fascias to go on, what few gutters we have are on and the scaffolding was taken down in December (Nearly 4 months after the Zinc contractor left the site), after us having paid £4000 in over-charges to keep it up in the hope that the original installer would work with us to remedy the problems. Windows and doors are next on my agenda, we're close to a window order, so I need to focus on the issues that are preventing that. -

How to regain traction...

Mulberry View replied to Mulberry View's topic in General Self Build & DIY Discussion

There are some pictures on this thread, but further issues have emerged since. The world of Zinc-roofers is a weird one. I'm sure other sectors are the same, but they all love throwing each other under the bus and the 2 other installers I've had round to look since both claim that are involved in current remedial work for the installer who did ours. Who do you believe?! The lasting problem is that none of them will warrant any 'repairs' they do and of course the original warranty will probably be voided as soon as anyone else touches it. -

How to regain traction...

Mulberry View replied to Mulberry View's topic in General Self Build & DIY Discussion

Thanks @JohnMo. It makes sense. There are things I am getting on with, but always with a level of reservation and dread about where this could all go. The roof is reasonably secure, it is 99% water-tight, save for large bit of plastic sheeting that protects the incomplete box gutter flashing (the flashing renders our roof technically 'incomplete' and therefore the final payment is not legitimately due). This sheeting disintegrated in the uncharacteristic winds we had earlier this week, but I've replaced that now and I think it'll last. The slight worry is that if we did crack on inside and any of the covers over the rooflights were to fail, we risk damage to the internal work. The covers have been made fairly robustly using 4x2 timber frames covered with UV-stable Polytunnel sheeting. Pigeons have pecked holes in the rooflight cover over the rooflight in our upper 2-storey roof. I need to get up there and remedy that, but with no scaffolding, I'm scared to make that climb. With occasional help, I am the only person working on this. The Zinc contractor was the first and, so far, only major external contractor. We could not have afforded to do this without being true self-builders, hence the roof issue could really sink us. -

How to regain traction...

Mulberry View replied to Mulberry View's topic in General Self Build & DIY Discussion

@Nick Laslett I am always grateful for your words of encouragement. I know you're right, I need to move on, if for no other reason than to complete some rewarding tasks. It is only really the fear of worsening the depth of the hole we're in, but, as @Russell griffiths has alluded to, we have to mentally prepare for every possible outcome and not pin our hopes on the most ideal one. I really cannot see how we don't have a great case and the way our Solicitor has articulated it so far is a very good sign. We are close to some big decisions and I am famous for panicking just as the trigger is about to be pulled, so this isn't abnormal for me, but there is no doubt, the collective clusterf**k has really snowballed for us. I hope you manage to sort all your issues, it's a dread of mine to have lasting problems as the very reason we took this project on was because I could never get over the weaknesses in the fabric of the 1920's bungalow we renovated before this and hoped we could achieve perfection, which I now know to be an unrealistic expectation! -

How to regain traction...

Mulberry View replied to Mulberry View's topic in General Self Build & DIY Discussion

You are right, the roof is largely water-tight, but we do have 3 large rooflight openings that have plastic sheeted frames over them that I battle to keep true and in place. The rabbit-hole scenario with the roof could be that if the Zinc is deemed to be beyond economic repair and has to be removed, then the Insulation would also be written off because the clips fasten through thick plastic plugs, so the Celotex is peppered with significant holes (probably around 15mm diameter). Once the Insulation is removed and the VCL is revealed we run the risk of the next installer not being happy with the way the VCL was fitted and wanting that off too, god only knows how you remove that stuff without writing the Plywood off. You see how my mind works?! I am very grateful for your advice though, I do want to keep moving on I am just a chronic over-thinker who is worried about getting even deeper in the proverbial you-know-what. There's no doubt that I could not have got as far as I have without the good people of Buildhub. I have plenty more headscratchers in front of me yet, so brace yourselves for more! I ought to post some photos of my work so far as there are some positives hidden amongst all of this. -

How to regain traction...

Mulberry View replied to Mulberry View's topic in General Self Build & DIY Discussion

The initial problem was the way the upstands were detailed, preventing £11k worth of Velux rooflights being fitted and this is quite serious in the sense that the only real way to remedy it is to raise the upstands, but this is a monstrous job that would involve cutting the VCL even if it was practical to achieve. As time has gone on, other defects have emerged. There is a lack of any expansion room behind the rooflights, which, I am told is pretty serious. Especially as one of them has 11m of Zinc above it with a potential expansion of 15mm+ over that length. There is also an integral 5m long box gutter with only 100mm upstand along it's length, which, according to VM Zinc should be 200mm. The box gutter went in first, so it can't be remedied without drastic work. -

How to regain traction...

Mulberry View replied to Mulberry View's topic in General Self Build & DIY Discussion

We're totally minded on getting an Expert Witness, but have been advised to get a bit further into the legal action first. Which we hope will be within a few weeks. Whether that expert will be the one who we rely on for Zinc roof specifics I don't really know, but I do think it will cross over in any case. As for a Governing body, we were told it's the FTMRC (Federation of Traditional Metal Roofing Contractors), but it turns out they're not really a proper governing body, so who knows. Hopefully that will emerge in the legal journey. -

How to regain traction...

Mulberry View replied to Mulberry View's topic in General Self Build & DIY Discussion

That's totally the conversation the Wife and I have just had. At this point, we have two choices, pay for the roof to be stripped and done again (that would consume about a quarter of our remaining already tight budget), or chance it in court. What would you do?! ☠️ -

Some of you know the woes we face with our Zinc Roof. The first major contractor on site and it all ended in disaster. You can read more about it here. It's trundling slowly down the legal pathway and is likely to take a long time because the contractor is simply not cooperating at all. But I need to be able establish a plan to progress as it's causing me a lot of anxiety. The house build is my occupation and to not be able to move on at any pace is giving me a sense of failure and not helping my self esteem at all. I'm finding bits and pieces to do, but we certainly face ANOTHER winter in the Caravan after SWMBO saying that Christmas 2024 was the last she'd do in the Caravan. In a nutshell, we paid £20k for an Architectural package that got us to RIBA Stage 4a (Building Regs Plans), but the relationship with our Architect broke right down towards the end of that and, in some ways, we were glad because it was the biggest stressor. However, I do attribute the lack of an Architect as to why the roof went the way it did. Had I known how hard our roof would be to detail and how many worrying elements we would be stuck with, we would have pushed back. But what would that have meant for the design we were overall happy with and we had planning approval on? Maybe a total redesign. So we went for it, we trusted an expert who assured us that any missing details would be taken care of by their "superior experience". He had so much to say about how it wouldn't have mattered if the Architect had detailed it, they know best where Zinc is concerned. We felt confident. Cutting a long story short, I honestly think the whole lot heeds to come off and a different system used. VM Zinc just don't offer a nice detail for rooflights in a 5° Monopitch without a tonne of solder. My question is, what did we do wrong? Should we have had an Architect produce a full set of technical details ahead of tender? Should we have relied on a specialist installer but with drawings to sign off before work started? I'm trying to foresee how to get out of the hole we're in because the problems have to be fixed, regardless of the court outcome. The advice I'm seeking is not about what to do with the legal stuff, but how we can get things moving on site again. Should I be trying to get another Architect or Architectural Technician onto the project to re-design and detail the roof? Or can I rely on a metal roof installation company to provide the full detail package within their quote? In essence, I need to know that a good outcome is guaranteed because it feels hard to commit to the big ticket items (Windows etc) without knowing where we stand and that the design can even be roofed reliably. I also realise that if we go any further with the internal works (Insulation/UFH/Screed), the scaffolding for the re-roof might then have to be a top-hat (££££££££). A part of me knows that we eventually need to take the original Architect to court, but with the roof action going on and the project as a whole, there's no way I can contend with that at the moment, even though I know that if it was to swing in our favour, the outcome could mean an answer to all this mess. Hoping for some rational and practical help from the good chaps and chapesses of Buildhub!

-

Crappy roof junction detail...

Mulberry View replied to Mulberry View's topic in Insulated Concrete Formwork (ICF)

All very well, but there's about 60 metres to do. It'd have a lot of joins too. -

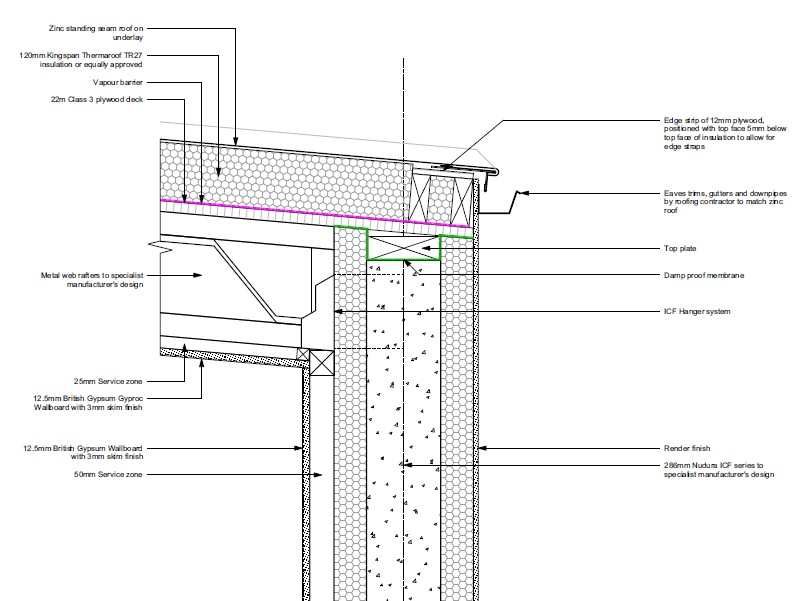

I'm fighting for my life trying to get our house water-tight, after the relationship with our Architect broke down, hemorrhaging money trying to get other Architects to fill in the blanks. I built the shell as per the plans and sadly didn't think hard enough about the next steps. This is what I have at my roofline... That's a 200mm timber hard-edge upstand, it contains the Celotex for the warm room. This is how the Architect detailed it... Clearly we cannot render directly onto Timber. I spotted it after the shell was built and so added an extra 50mm around the perimeter of the roof in a late-stage adhoc amendment, to enable an overhang big enough to take a secondary layer of EPS that I would add to the whole building to cover everything up and give a single layer to render onto. However, I'm now second-guessing it, does the timber need ventilating? Would I be better to utilise a rain-screen system here? I'm thinking of vertical tile-battens with render board attached and render onto that with an airflow passage behind it. Any help is VERY much appreciated.

-

External Vent Heights...

Mulberry View replied to Mulberry View's topic in General Self Build & DIY Discussion

They look neat, but what stops the rainwater going in?