BrettW

Members-

Posts

21 -

Joined

-

Last visited

Everything posted by BrettW

-

Hi @dnb, Great to come across a fellow Islander! We are in Ryde and have been looking for plots for 18 months! How did you find yours? Any advice? Would love to chat more Thanks Brett

-

Thanks @nod & @ProDave this is where its not clear, worse case if i cant borrow against the land my father will gift it as its quite reliant to help kick of the build but dont want to rule leasing out..

-

Hi Dave, To be honest he hasn't gone into to much detail but im pretty sure to be seen as being fair because i'm 1 of 6 children! Im the only one who is in a position to do this, so wants to be seen as being as fair as possible, maybe on his death i get the freehold and my siblings get my share of inheritance, no idea what his thinking is at the moment, all assumptions, i think if leasing means i can't get any of the land value would mean gifting the land and we have a separate agreement between us siblings, who knows, so in my head it might be ruling out the idea of leasing the land so he can say he tried that angle...not sure if any of this makes sense! Must admit im not sure of there is any immediate benefit of him leasing me the land as you say? Unless its so he can say to my siblings he hasn't given me the land, plus he wont be helping me financially with the build either... Cheers

-

Hi all, Just a quick question although I should be gifted land by my parents my father has raised the idea of 'leasing' me the land (say a 1000 year lease), does this make a difference with regards to getting a mortgage to build on it? Would the bank still lend based on the value of the land? For example a lender has said they would lend up to 85% of the value of the land if it was gifted to me? Would they still lend me to me on that basis if I was leasing the land? Thanks all.

-

Hi Bob, If it helps I just learnt (Buildloan) that most lends will lend 4.5x times your income not just 4x, does that make a difference to you? Cheers

-

The planner I’ve never met in my life...he was the most positive about it all. Brett

-

4 x would work for us I think, in standard residential mortgages they maybe go up to 4.5 times, not heard of 5 times sadly...

-

I should clarify, ive paid £140 + VAT (£168) for the planner to come to the plot, give his opinion, create a full report with research and his viewpoint (thinks planning permission is achievable) And ive spent £100 for my architect (whos also a friend) to do that plan plus he's helped on a few other bits... Cheers Brett

-

Thanks @Ferdinand great advice! Glad you see it as a possible/positive project, i appreciate its access thats key right now.. Yep planner made us aware about it being a third of the uplift plot value, curious to know more about expenses though? What kind of expenses can be 'included' right now ive paid around £270 in getting a planner round and a quick sketch as above...keen to not go for planning until we know we have access, would an agreement with the neighbour be a conditional agreement? Thanks again Brett

-

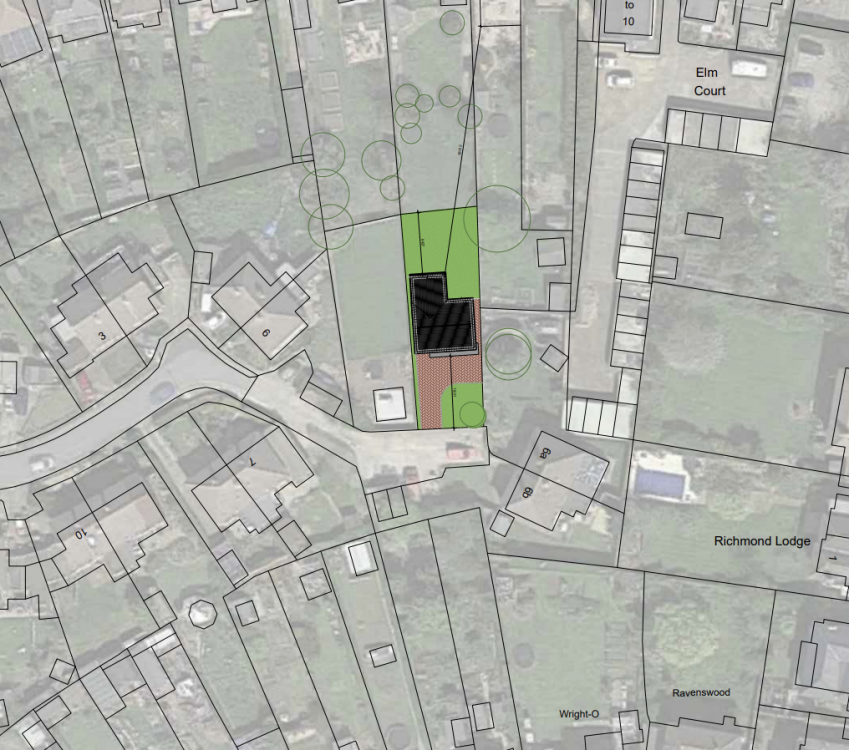

You can see a very early draft example (THIS ISNT THE HOUSE WE ARE PLANNING, PURELY BOILERPLATE 4 BEDROOM DETACHED DWELLING TO SHOW THE NEIGHBOUR ) .. Brett

-

That circle is super rough. It’s actually 10.5m by 30m plot. Cheers

-

Thanks Temp! Great advice...

-

Thanks Ian, all really helpful, we are literally going to talk to him as soon as i hear back about mortgages options, even maybe later this week, as you say, will talk to him face to face and do my pitch! Services wise the planner we had round said we could just make use of my parents services in theory... Cheers

-

Its shared access but owned outright by one neighbour (furthest away semi on the right), other neighbour has right of way...we know them, hes in his mid seventies, we know he wants some cash, so feel confident for a deal, just want to be sure we can get the mortgage we need etc bu yes not signed, sealed or delivered by any means Not gone that far yet with services....any pointers welcome! Cheers

-

Thanks @andyr87 makes sense, not designed the house yet but just sent my architect the comment about the SAP rating of 85 or above, could be a way forward! Looking to build on my parents garden...see pic to give an indication..planner has been round and feels very confident... All very new to me! Cheers Brett

-

Thanks Andy, really useful, yes already came across the Halifax rule, glad things are progressing for you, is Ecology lending 4 times your income? 4 times is what we need ideally, doing this as joint income with my wife. Did you try Buildstore at all? Thanks all.

-

Oh yes already understood that, im just trying to fully understand all the benefits of owning the land when it comes to mortgages.. Cheers Brett

-

Just seen you latest reply.. Brett

-

Thanks Ragg987, So by offering the land as a deposit banks may loan money sooner than later? Ive always read that you normally need to fund the first stage of a build as money is lent in arrears.. Cheers Brett

-

Thanks Steamy Tea, Some good points! I guess im asking more so from the mortgage lender, could they lend more on the build cost? Does it help LTV? Brett

-

Hi all, Im new here and just starting out on hopefully a journey to a self-build property, such a great forum here. Now I’m looking into mortgages and wanted to get clarity on something if possible. Shortly land is being gifted to me from my parents, with PP this plot will be worth £100k and I will own it outright, now I see some folks say this can be used as a deposit for when applying for a mortgage…for some reason I can’t work out how this works.. So, if we need 200k to build the house on the land how does the land benefit the mortgage? I mean I still need to borrow 200k? How is the land as a deposit factored in? Can I make use of the equity in the land somehow? Sorry if im just not getting it.. Thank you. Brett