Kevan Marshall

Members-

Posts

101 -

Joined

-

Last visited

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

Kevan Marshall's Achievements

Regular Member (4/5)

7

Reputation

-

Installing storm drain below public road

Kevan Marshall replied to Kevan Marshall's topic in Waste & Sewerage

I am going to phone several companies to discuss options of open cut and trenchless options, whatever I go for I feel like it is going to be expensive…🥲 -

Installing storm drain below public road

Kevan Marshall replied to Kevan Marshall's topic in Waste & Sewerage

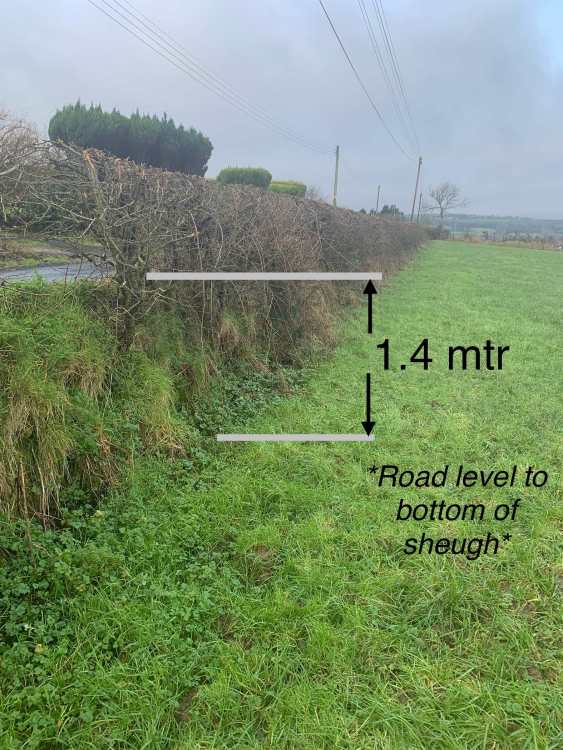

I can dig a trench on my plot, the other side is 1.4 mtrs below my plot and drain below road would run into drain in farmers field.. -

Installing storm drain below public road

Kevan Marshall replied to Kevan Marshall's topic in Waste & Sewerage

Yes unfortunately in Northern Ireland everything involved with roads, environment and planning takes months and months, if I go down the open trench route this could be an issue as although it is a dead end small road there is a lot of farm traffic, traffic to houses, people going to the beach, who ever was opening up the road would need steel plates on standby to let traffic by, I have one mains water pipe running along the grass verge, no sewage electricity or anything else, is it possible you could PM your friends details please? -

Installing storm drain below public road

Kevan Marshall replied to Kevan Marshall's topic in Waste & Sewerage

That would be an option but the two culverts are 10 meters left an right from the sides of my plot, when I looked at the stone culverts one was collapsed below the road and the other is really only suitable for septic tank run off, when my site floods it really floods, it never used to happen but now it floods badly two or three times in the winter -

Installing storm drain below public road

Kevan Marshall replied to Kevan Marshall's topic in Waste & Sewerage

Unfortunately there is no easy solution, I need to ensure no storm water is running through over my site, I cannot put any form of bank or wall at rear of the site as this shall divert storm water through my neighbours garden, this was highlighted with objecections from both neighbours at planning stage, planning was granted as I said I would resolve this issue, no objections from the environmental agency as they said it was not on a flood plain, I need this resolved once and for all so I never have issues in the future, at the rear of plot I am installing a storm channel with flag stones on top with a 2cm gap between them and galvanised storm grating at lowest point, then run an 8”/10” drain through the sight and under the road to the field across the road, I could tie the drain to be installed through my site into two small 4” sewage pipes from both neighbours but during heavy rain this may create issues with sewage backing up, I also do not want to finish my house and landscaping then have to dig things up again due to trying to cut corners at this stage -

Installing storm drain below public road

Kevan Marshall replied to Kevan Marshall's topic in Waste & Sewerage

-

Installing storm drain below public road

Kevan Marshall replied to Kevan Marshall's topic in Waste & Sewerage

-

Hi, On the plot I have bought we have flooding issues with water running off the farmers field at the rear, through the sight and running across single track public road then going into field in opposite side of the road, I plan to install storm channel at rear of site and pipe to front of site, I was going to pipe into two small stone culverts that go under the road but they are connected to neighbours sewage outlets and may cause issues during heavy rain, I want to install my own pipe below the road and into the field opposite into the ditch, the farmer is ok with this, has anyone ever installed an 8” or 10” pipe using horizontal auger boring and how expensive was it, to dig up the road and install a culvert would be a nightmare by the sounds of it, any advice would be very much appreciated! Kev.

-

SIP experienced contractor

Kevan Marshall replied to Sabine's topic in Structural Insulated Panels (SIPs)

Where abouts are you based?- 8 replies

-

- sip

- contractor

-

(and 6 more)

Tagged with:

-

Electrical meter box location

Kevan Marshall replied to Kevan Marshall's topic in Networks, AV, Security & Automation

Thank you Conor, I shall speak to the SIP’s company after the holidays, maybe have to install a double panel or something to accommodate, the meter box shall back onto a storage cupboard, NIE said I could build a block built box that was attached to house but dimensions were nearly 1.8mtrs tall x 1.2mtrs wide -

Just had a phone call from NIE asking me a questions about power consumption I would need, the guy said if I wanted a larger supply I would need to upgrade the transformer on the pole which is 150mtrs away, he said that could end up being tens of thousands, he said that maximum supply of existing pole outside property is 18.4kw/80a, price for standard connection may be between 2k and 5k, if cable is more than 33mtrs long that’s another 2k to put joint in it (do cables only come in 33mtr lengths), he also said allow 10mtrs for the pole side so only 23mtrs from pole to meter box, I explained I may use a welder occasionally and I shall probably end up selling my large welding machine and buying a smaller inverter type but he was still a little concerned even though I can draw 8kw maximum from a modern 250amp multi process welding machine, everything else I shall have shall be an electric range cooker, general sockets and lighting and a hot tub if my wife gets her own way, I’ll wait for the official quote to come through…

-

Thanks Nick, I’ll get in touch with NIE tomorrow and explain what I’ll be using, I went in heavy with what I needed on the online forms to future proof incase I install EV charging and a heat pump but I cannot see that happening, I can also install a gas range cooker if need be…

-

I shall request if 100a is available, I know they try and only give an 80a supply on standard connections, if I need to I’ll sell my two big old welders and get a smaller machine that can run off 32amps, I’ll see what price the give me for upgrading as it may future proof things…

-

Just had NIE respond to my application for new electricity connection, to supply power from existing pole outside the plot they can give me 18kva 80a connection, I shall only use range electric cooker in the house, normal sockets, normal led lighting, in my garage normal led lighting, 13a sockets but require more power for my welder, my welder could potentially run off a 63a supply but I may sell it for a smaller welding machine (32a supply) rather than upgrade which would require running a new supply from 4 poles away, how many amps supply do most people go for in their new builds?

-

Thank you Gus, For me it is turning into an obsession, I also work abroad six months of the year but I am basically my own boss so I have lots of time to research things for when I come home every 5 weeks!