NJLJ2024

Members-

Posts

14 -

Joined

-

Last visited

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

NJLJ2024's Achievements

Member (3/5)

1

Reputation

-

Offer accepted, but funds wiped out from land purchase.

NJLJ2024 replied to flanagaj's topic in Self Build Mortgages

Agree post build the rent won’t be factored in as this will no longer be an expense, but question mark over how they factor the rent into your affordability throughout the build - though I would’ve thought the affordability would be less impacted as it’ll be funded in stages, so you’re borrowing less than the total amount. One to check with broker 😊 Cool, the less commitments you have going out the more chance you have of passing the affordability assessment. Plus you should’ve built up a good credit history through your historical mortgage payments so sounds like in theory you should be in a good place on this part. Clearscore or credit karma are free services. -

Offer accepted, but funds wiped out from land purchase.

NJLJ2024 replied to flanagaj's topic in Self Build Mortgages

As a starting point, most lenders seem comfortable with lending on up to 4-4.5x your salary. As its joint this will be combined salary, so you might expect to be ‘allowed’ to borrow around £160k - £180k. But…there will be a lot of things that factor into this. For one - do you have any adverse credit - CCJ’s, bankruptcies etc. If so you’ll be classed as high risk and may struggle. On the other hand, if you’ve never borrowed any money, you may also struggle! The lender would normally assess the amount of existing credit you have in place and whether taking this new debt on will be affordable or could put you in financial difficulty. E.g if your combined earnings are £2666 monthly, let’s say new mortgage is £1000 monthly, leaves £1666 per month to live off. Would this be enough to cover your current commitments, plus essential spend such as food, fuel etc. Lenders role will be to assess that and then advise what they’d be willing to lend on. Note it can be slightly harder for self employed to get a mortgage vs those with standard salaried jobs (lenders want to see stable, predictable income which isn’t always case for self employed due to seasonality or just peaks and troughs). Brokers will help connect you with the most ‘suited’ lenders based on your circumstances. Recommend you and wife pull free credit report if you haven’t done so already, this should give you a good indication of how you’re likely to be seen by a lender from a credit risk perspective at least. -

Self Build Mortgage - 100% timber house and deposits

NJLJ2024 replied to NJLJ2024's topic in Self Build Mortgages

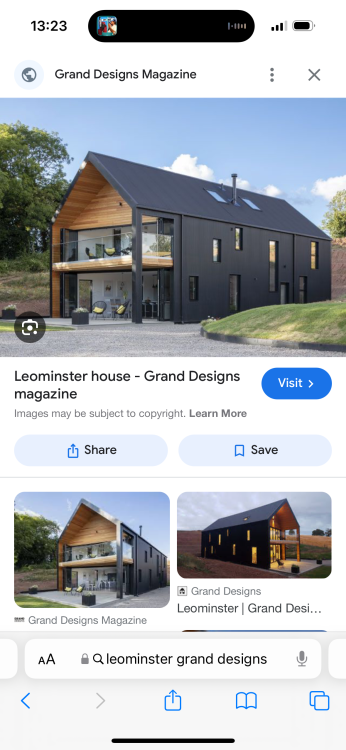

That’s useful to know on building regs thank you, I am hoping the timber companies that have quoted will have done this but definitely one for us to check! We saw an episode of grand designs last week and their house shape and design looks very similar to ours. They used corrugated steel cladding with timber at front and it turned out beautifully - image attached. -

Self Build Mortgage - 100% timber house and deposits

NJLJ2024 replied to NJLJ2024's topic in Self Build Mortgages

Thank you this is really useful! My partner mentioned that he actually submitted a CIL form as the council asked for it to be completed when we submitted our docs. Will make sure we properly research the process so we’re fully clued up and don’t miss anything! -

Self Build Mortgage - 100% timber house and deposits

NJLJ2024 replied to NJLJ2024's topic in Self Build Mortgages

Thanks, we noticed ours is up on the council site now (exciting!) Partner has been looking at other applications tonight but majority appear to be extensions rather than self builds like ours. Great shout on looking at the successful ones, we’ll get on this tomorrow thank you. With it being a rural area our thought process guided us to 100% timber, still such an unknown in terms of who will be willing to lend on that type though. I’ve taken a look at fibre cement board and aesthetically they look similar so well perhaps go this route if the mortgage proves a challenge. Yes really promising on the land part - we were worried how much this would make a dent in the deposit so it’s nice to know it may be more substantial than we first thought. Yep I’m regularly reading up on various topics here and learning something new every time! Guilty on the bathroom part 😂 -

Self Build Mortgage - 100% timber house and deposits

NJLJ2024 replied to NJLJ2024's topic in Self Build Mortgages

Thank you so much for the in depth view of how you've gone about it - we are leaning towards this as an option so it's great to see some of the things you've done. I've created a whole list of lenders and whittled it down to around 7 with deposits ranging between 5% and 20% that we think meets our needs and seem to have some level of appetite to lend on timber frames with cladding. So next step is to call them up and see what their requirements will be re construction method. -

Self Build Mortgage - 100% timber house and deposits

NJLJ2024 replied to NJLJ2024's topic in Self Build Mortgages

Ok, this is super useful to know thanks. We have all of our drawings already so next job on the list is to find an estate agent that can value it for us. Hadn't even come across CIL exemptions so thank you for raising - we've added it to our list of stuff to box off! -

Self Build Mortgage - 100% timber house and deposits

NJLJ2024 replied to NJLJ2024's topic in Self Build Mortgages

Thank you! I did think this originally but I’ve seen that an acre is typically worth £12-£15k and we only have 100sqm which I believe is 0.02 of an acre so if my maths is right the value would be around £300 which doesn’t sound right 🤔 I’ve seen zoopla price per sqm is £1526 so very different calculations neither of which I think sound very accurate! Not sure if you might have a rough idea of what 100sqm may be worth? It’s farmland currently next to his parents house. We plan to get an estate agent to value it as best case scenario it might take away some of our money worries! Great thank you, I think my partner has got someone to glance over this at work (they deal with this type of stuff for commercial buildings) but I’ll double check with him on this. Assume we will need an official qs to review this so will get it on it. So we are planning to use a timber frame company to erect the frame and add sips and then another company to install cladding etc. It’s more the internal works that we are trying to do ourselves with the helps of skilled people we know. I am a little attached to my flat as I’ve lived in it for the last 10 years and it was my first home. Ironically I’ve been stuck here because of the cladding issues but the works are finally coming to any end all these years on! The mortgage is very affordable and with it being in Leeds city centre the rental yield would be good. Need to see what the deposit requirements look like but it’s definitely an option, either that or maybe releasing some equity to get some more cash in the bank for the build! -

Self Build Mortgage - 100% timber house and deposits

NJLJ2024 replied to NJLJ2024's topic in Self Build Mortgages

Interesting - fibre cement board cladding was mentioned as an option the other day at the home building and renovating show. We were wondering if this would negate the need for us to put a brick skin under the timber decorative cladding if we decided to still take this route. I assume the lender was satisfied with this and didn’t add it to list of non standard construction? -

Self Build Mortgage - 100% timber house and deposits

NJLJ2024 replied to NJLJ2024's topic in Self Build Mortgages

Yes this is a fair point! I need to do my research on what type of cladding would be most resistant to our very cold and wet climate! We are really keen on the aesthetics of the wood finish but equally need to think about the longevity of it - we saw a grand designs that had a very similar look to what we are planning and they used corrugated steel cladding, they did still have a wood like finish on the front of the house - not sure if this was timber or a different material! Good point on the roof lights also thank you! -

Self Build Mortgage - 100% timber house and deposits

NJLJ2024 replied to NJLJ2024's topic in Self Build Mortgages

Thank you for the useful tips! We are yet to experience the fun of building regs part of this! 😆 Good point on bedroom without window - will mention this to my partner as he actually did the drawings and will be able to incorporate some changes as we liaise with the council re planning permission. Think we need to have a read up on all the regs to know what to look out for! -

Self Build Mortgage - 100% timber house and deposits

NJLJ2024 posted a topic in Self Build Mortgages

Hi all, My partner and I are in our early 30s. We have recently been gifted a modest plot of land (100sqm in total) and we are looking at a self build project. We're quickly realising the many things that need to be considered so I'm sure I'll be leaning on the forum's expertise in the coming months! The first thing we are trying to get clear on is finances... I've provided a brief summary of our situation below: Two story, two bed house - 66 sqm in total (images attached) Timber frame, timber clad eco house (though the more we research the more we are getting nervous with the 100% timber approach due to lenders classing this as non-standard construction) Partner works for a commercial construction company so there are certain things we will be able to source through them at a cheaper rate e.g foundations. He is also an ex plasterer and has good access to other tradies e.g electrians so should be able to get the costs down here Total costings have so far been calculated by us, and we are estimating around £160k - £180k. There is movement on this figure as there are certain elements we may choose to retain or strip out depending on how the deposit requirements look. We have submitted for planning permission with the council and they are in the early stages of reviewing our application We have been advised we should be able to borrow in the region of £450k and realistically we are looking to borrow a maximum of £200k. Mortgage affordability isn't an issue, but depost may be (currently have around £21k saved, but should be able to increase this to around £36k in the next 6 months as we tighten up on budgets). We were exploring the 5% help to build scheme as this looked attractive based on the low deposit requirements, however reading into this more it seems like this may not be the best route due to the interest rates being applied to the end value of the house once built. I also have a mortgaged flat with around £80k equity in it but in an ideal world I would like to keep the flat and rent it out to give us a nest egg for the future. Would be keen to get others thoughts on this - do you think this is the right approach or will we need to be 'cash rich' to be taking on a self build project? The norm for deposits seems to be 20-25% but I did come across Chorley Building Society who have a 15% option available. I've made a long list of self build lenders to work through and see if I can find any others - if you're aware of any please let me know as this would be a huge help to us considering our cash position at the moment! There is still a big question mark over whether or not a timber frame and timber clad house is the right route? I've seen one other post on here with varying opinions and I spoke with Build Store who said their lenders require at least 50% to be another material. However I spoke with Ecology at the Home Show this weekend and they don't seem to think this is would be an issue. My concern is that we limit ourselves to one or two lenders and therefore have access to worse rates/higher deposit requirements which we're keen to avoid! Does anyone have any thoughts or advice on this please? Apologies in advance if any of this is a stupid question, we're new to this so just finding out feet! Thank you Visuals.pdf