Furnace

Members-

Posts

238 -

Joined

-

Last visited

-

Days Won

1

Furnace last won the day on March 14 2023

Furnace had the most liked content!

Personal Information

-

Location

Kent

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

Furnace's Achievements

Regular Member (4/5)

54

Reputation

-

UK Power Networks info required for new supply

Furnace replied to Furnace's topic in General Self Build & DIY Discussion

Thanks team. I'll let you know how they respond. It all feels overkill, but maybe I'm an (ignorant) cynic..... -

UK Power Networks info required for new supply

Furnace replied to Furnace's topic in General Self Build & DIY Discussion

Thanks team, Since it's a single dwelling residential plot (with no lifts street lighting, cranes or small hydro-electrical dam) I queried it via email and received a fluffy reply. Thank you for your email. It looks like your job was originally with our Small Services Team, however they passed this to our Department (Projects) and advised you wanted a three-phase supply, a single phase service alteration and an overhead to underground mains diversion with pole removal – is this correct? When it comes to our department, we usually require some more information than the Small Services team, due to the type of request. Any questions do let us know. I'll dream up some numbers and hope the project is passed back to the Small Services Team. -

UK Power Networks info required for new supply

Furnace replied to Furnace's topic in General Self Build & DIY Discussion

Do you think so? Should I risk their wrath by querying it? -

UKPN have requested I supply info that seems to befit a small town rather than the single residential dwelling for which I'm seeking the supply. Thank you for the information that you have recently provided regarding the above project. A Project Designer has reviewed your file and unfortunately, we are unable to proceed with your application as some of the information that we require is missing as per the current OFGEM regulations. In order for us to continue with your Quotation as quickly and accurately as possible, please could you provide us with the following information:- · An accurate breakdown of the required kVA/kW load/generation including landlord supplies and street lighting if applicable. Please remember that you are obliged to confirm your electrical requirements. The attached document shows the average loadings, but this is only a guide and you should contact your electrical contractor to confirm the information - · Type of heating for each unit/dwelling - If electric, please indicate the number of heaters and the kW rating of each - - If air or ground source heat pumps are to be used please provide the motor/pump details, as follows: - Size in kW - Single or three phase - Starting method (e.g. direct on-line, star delta, soft start) - Starting and running currents (your supplier or manufacturer should be able to provide these for you) - Frequency of starting (e.g. twice per hour, once per day etc.) - Please also remember to include the details for the back-up heater should your unit contain one (please send the specification sheet if available). · Electric Vehicle Charger - Please can you confirm the amount of chargers that are to be installed?- - Provide the manufacturers Declaration of Conformity Certificate (to give us confidence that the equipment being compliant to the relevant IEC61000 standard) - - Manufacturers Data Sheet - - Harmonic Data sheet - · Details of any Lifts/Pumps/Motors/Welders/ /Air Conditioning units/Cranes/Silos - - Please provide the following details: - Size kW/horse power - Single or three phase - Starting method (i.e. soft start, star delta, DOL etc.) - Starting/Running current - Frequent or Infrequent use - Point of wave switching (for welders only) It's an (unbuilt) 4 bed Passive House, 225 m2, 28kW solar PV array, 3-phase supply. Needs capacity for a heat pump (although I won't install one since I'm proposing to use a Willis heater) and a EV charger. I've specced a Myenergi zappi – multiphase ev charger 7kW single phase; 22kW 3-phase and got the spec sheets required. Any suggestions for heatpump? And the expected "required load/generation"? I feel out of my depth. Again

-

At that price 7kw will cost £6600. You would also need to purchase their roofing system, materials including guttering and down pipes for a roof 230m2 is coming in at £14k. My only problem is finding someone to install the roof, their recommended supplier has come in with a quote of £19k labour only installation! The other option is Roofit, there are a few suppliers in the UK, supply and install is coming in at around £50k for 7kw. If anyone can recommend reasonably priced installer in South Wales I would be very grateful. Have you decided on a way forward? I've got space for about 20kW on a standing seam roof (not yet built) and am curious about options other than S-5 brackets and regular panels

-

Good to know. What are the dimensions of the balcony? I've heard it suggested that one that is too narrow (house to railing) is rarely used. Ta

-

Having lived with it for a year or so, what's your verdict?

-

Indeed. I'm sceptical of damp stuff. I understand it can often be due to poor guttering/leaking pipes rather than 'rising damp' so that has been the first area for inspection. Water in the ground has to go somewhere, so stopping it in one place can often force it to another. Then there's the whole breathability issue. I certainly didn't encourage her when a basement garden flat was on her wish list.... Not the sort of guarantee she was after...

-

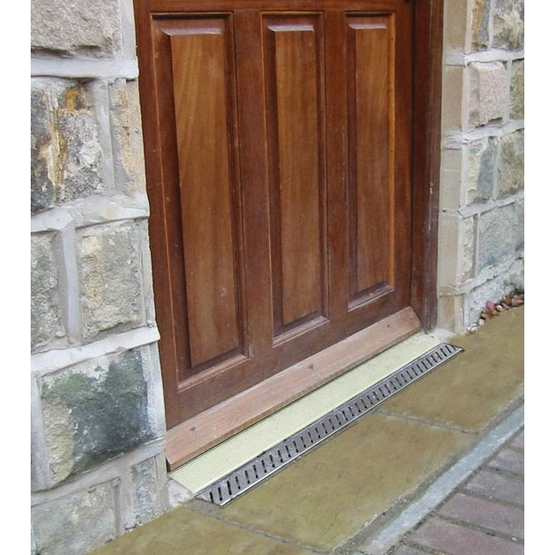

My daughter's London basement flat has a damp issue. She's had a 'damp specialist' report that proposes various remedies including chemical damp proof in places and tanking slurry in others. In addition, the patio door cill and base of the stiles have rotted as the cill is at exterior FFL. Do the experts think the patio door issue could be resolved by installing a threshold drain directly adjacent to the cill and bedding the new door on a dpm and sealant? Or does the exterior concrete (about 15sqm) need to be lowered to achieve the typical 'all thresholds are 2 brick courses above exterior FFL' TIA Mark

-

Mitigating Risk With Upfront Payments To Timber Frame Companies?

Furnace replied to thefoxesmaltings's topic in Timber Frame

No one likes credit risk, unless they're being paid a fair price for it. The current situation benefits only the suppliers. I lend money to plenty of companies, but at a rate I think is fair for the adopted risk. Many forum members do this too via savings and pensions etc. It feels uncomfortable to lend money to a supplier via paying prior to receipt of goods - I'm providing their working capital for free and have no recourse (other than being an unsecured general creditor) if they run into difficulties. I'm happy to self-insure when buying a £10 book on Gumtree, not when stumping up £200k. I'd be happy to pay a modest premium to mitigate the exposure, I'm just not sure 6% for 6 months' cover is 'fair'. -

Mitigating Risk With Upfront Payments To Timber Frame Companies?

Furnace replied to thefoxesmaltings's topic in Timber Frame

The requirement for collateral is because there is a real risk of loss, and that is the business banks are in. I'm wanting to build a house, not lend money to a housebuilder. -

Mitigating Risk With Upfront Payments To Timber Frame Companies?

Furnace replied to thefoxesmaltings's topic in Timber Frame

Hence I think escrow is a good idea, and fair Business to business trade is exposed to this all the time, and often deal with it via standardised trade finance/letters of credit. We are in the twilight world of business-to-customer, but with the amounts of money in line with business-to-business. -

Mitigating Risk With Upfront Payments To Timber Frame Companies?

Furnace replied to thefoxesmaltings's topic in Timber Frame

That sounds high. Probably covers a large portion of the materials, yet no materials are needed at that stage. Companies go bust 'unexpectedly' all the time. I don't have the information to know which one it will be, and I'm not (any longer) in the business of betting on creditworthiness. The amount of money at risk is enough that I wouldn't pay upfront without mitigation in place, and that's not because I don't think MBC is a good company. It probably is, but I don't want to take the risk. -

Mitigating Risk With Upfront Payments To Timber Frame Companies?

Furnace replied to thefoxesmaltings's topic in Timber Frame

I spoke at reasonable length with a finance chap at MBC. They claim to have a lot of free cash (more than end-2021) so don't need the stage payments for working capital. I've no reason not to believe this. However, the owner is very conservative and doesn't wish to restrict himself if times become difficult and therefore is not willing to consider escrow or a bank-backed letter of credit that might affect his access to cash or funding. The offer of an insurer-backed facility is available since it doesn't affect his potential funding routes, but I think it's pricey (although not an 'insane level' @Nickfromwales) I can't think of another area of my life where I have, or would, consider exposing myself to another's creditworthiness for >£100k+. In personal transactions at these levels, I've bought and sold houses and cars over the years, and have only used "cash on delivery" or a conveyancer to remove credit risk. Unexpected things do happen. Which is why I use a credit card to pay for (almost) everything. I've only ever needed to claim on Section 75 once for a few hundred quid, but it's a nice comfort to have, and free. A 6% surcharge to remove credit risk with MBC seems expensive when making all payments into escrow would likely be cheaper and fairly straightforward. Here's a strawman. Stage 1 payment to cover plans for fabrication (10%) - released when drawings and structural calcs are completed and delivered. then Stage 2 payment made to cover cost of frame and delivery to site (40%) - released when frame is delivered to site. then Stage 3 payment made to cover erection (40%) - released when completed. then Stage 4 payment made to cover return to site after windows/doors fitted for blower test (10%) - released when test passed. Not too onerous on admin. and not unreasonable? -

Mitigating Risk With Upfront Payments To Timber Frame Companies?

Furnace replied to thefoxesmaltings's topic in Timber Frame

Indeed. As with all insurance, you'd prefer not to need to claim. But in the situation where it all goes horribly wrong, the premium paid and inconvenience of starting again seems small beer.