delta9

Members-

Posts

23 -

Joined

-

Last visited

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

delta9's Achievements

Member (3/5)

1

Reputation

-

Levelling Floor on concrete slab (with timber battens)

delta9 replied to delta9's topic in General Flooring

Makes sense to go for a liquid DPM i.e. Blackjack As we're doing away with the plastic cradles, I think 3x2's laid on the long side down would be better... That would give 38mm height with 15mm engineered oak = 53mm. 40mm PIR Insulation in between should fit... Allowing for packers so around 58mm finished floor. After the deck has been levelled with packers etc I can then bond the void under battens to the blackjack/concrete with Sikabond MS adhesive, I think this will give a really strong sub base. Does this sound ok? 😀 Cheers -

Levelling Floor on concrete slab (with timber battens)

delta9 replied to delta9's topic in General Flooring

Hi, Did you use dpm sheet? I think I need to put down dpm sheet as a vapour barrier or a liquid sealer 🤔 Probably best to fix the battens to concrete as well. Cheers -

Levelling Floor on concrete slab (with timber battens)

delta9 replied to delta9's topic in General Flooring

Hi, Yes I could just use ply packers as you suggest! Thanks -

Hi, Looking for some help please! Current concrete slab on ground floor (original 1960s+) is way out of level (approx 60mm in the worst areas) Liquid Screed it all is an option to get it all level, but I've been looking for alternative options. Any thoughts on battening the floor (with 20x45mm battens) using adjustable cradles to level the deck: https://www.roofingsuperstore.co.uk/product/eurodec-adjustable-decking-cradle.html The whole ground floor would be made up of: DPM 1000 gauge laid down and up around perimeter walls Cradles (minimum 10mm / Battens 20mm high) Minimum 20mm insulation installed between the battens at the low areas, high areas would have thicker insulation i.e. 50mm) 18mm T&G chipboard floorboards or possibly use 3mm ply and(or) 15mm engineered flooring instead Finished floor level (or to floorboard) would be about 50mm higher at the front door area, but the Upvc frame/threshold is about 70mm, so I think this would work out well. Have seen people installing battens/floating floors in garage conversions, but not seen it being done throughout the whole ground floor.... The benefits I can see, is that the floor would be insulated, I have calculated it cheaper than having screed pumped, it's easier to install yourself. Any thoughts on it ? Thank you

-

Ok great thanks 👍 They don't span >6m, they are resting on ground floor walls as you say, so they span about 3m + (sorry for the confusion) Yeah it looks like I need help from a SE 👍 Cheers

-

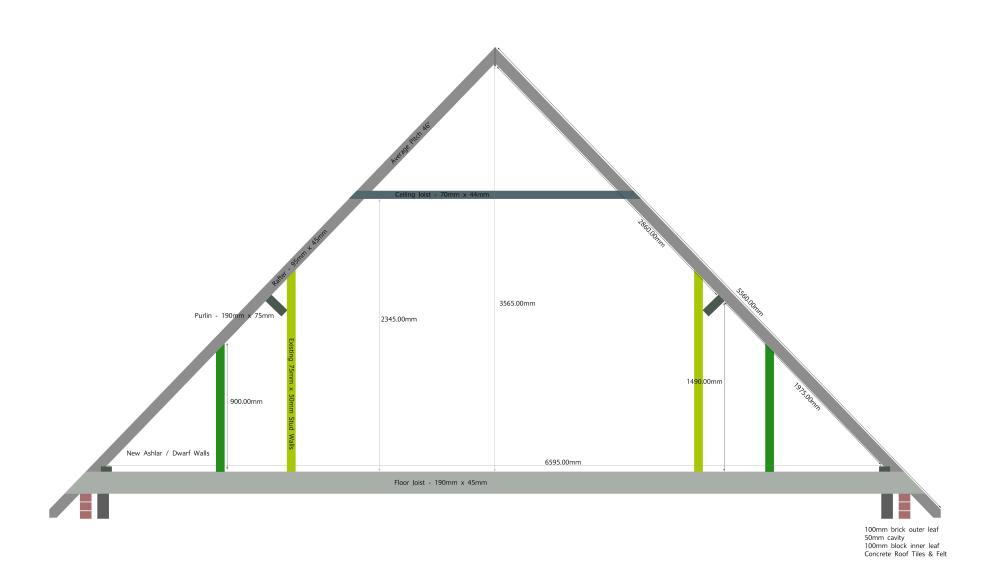

Cheers Temp for the advice, Good point on the 190mm floor joists 👍 Will try putting more than 150mm insulation if possible thanks 👍 Yes, that is correct with the felt roof and we did plan on the 50mm air gap (cold roof). Been reading/thinking since posting yesterday, I think the only way to achieve our plans is by removing the purlin completely and beefing up the existing rafters. Question is, do we actually need steels/flitch beam underneath the new ashlar wall? As you mentioned with the 190mm joists spanning over 6m, if these were not up to to spec, I suppose the solution would be to double these up (say every other joist) and in turn would these then be able to support the new ashlar walls 😬 Cheers

-

Hi Looking for some help and ideas! 😀 We are currently modernising a 1960s chalet type house (similar to the one pictured but not the actual house and no chimney present). Planning to install 150mm PIR insulation in the existing and new rafters and also planning on gaining a bit more space by removing the existing stud walls and installing ashlar/dwarf walls, with some wardrobe space behind these ashlars. The issue is the purlin is hindering the plans as it's sticking out a bit too far, ideally I think this would be best removed or perhaps there is another way (i.e. install a flitch beam 95mm x 75mm underneath existing purlin, then cut the existing purlin in half so it becomes 2 x 95mm x 75mm beams) but not sure if this can be done... I know in typical loft conversions, steels/flitch beams would be installed underneath the ashlars, but again unsure if this would be necessary in our case. Any ideas on how we achieve what we suggest? We are following the rules by the way, house is subject to building control approval for structural alternations. I've not contacted any structural engineers yet (it looking like I need to), just going through some ideas I can then put forward to him/her. Thanks for any help / ideas

-

Hi Roundtuit, Thank you for your post! That does make sense to have both deposits upfront as you say. I have enough money for the purchase deposit, but not enough money for the renovation deposit...

-

Hi there, Can anyone answer this query for me please: From the Ecology website: Are these deposits treated as separate transactions ? For example £100,000 for Property = £10,000 Deposit (10%) £40,000 for Renovation = £6,000 - £8,000 Deposit (15% - 20%). Do I need just £10,000 to purchase the property? And worry about the Renovation deposit at a later date i.e. 6 months after purchasing. Or would I need to put both deposits upfront from the word go i.e. £16,000 - £18,000. Would make sense to just put down 10,000 first as I expect in the first few months of renovating you would just ripping out stuff and hacking off walls etc prepping it which doesn't cost a fortune just manual labour etc which I would be doing at my own expense... But maybe the lender would need the full whack of deposits for their security... Not too sure how this works! Cheers for any advice, it would be much appreciated to hear from someone who has been down this route before!

-

Newbie Self-Builder - DIP / Fees / Costs Etc

delta9 replied to delta9's topic in Self Build Mortgages

Hi, Yeah that sounds like something to look into, there must be a way to do it. As I can't really afford to lose deposit money, I thought maybe about offering over the asking price rather than a deposit. Both parties then benefit if lender agrees to lend - The Landowner owner will get more profit and I get my plot. But its still a risk to me losing money on surveys etc if the Landowner does not honor the deal. Thanks for the help -

Newbie Self-Builder - DIP / Fees / Costs Etc

delta9 replied to delta9's topic in Self Build Mortgages

Hi, thanks for the replies! So from what I can gather, it would be at my expense (upfront costs) to conduct all these surveys on the plot before the lender will say yes, i.e. site surveys, ecological survey, flood risks, soil condition reports etc etc Further to this I assume they would require full planning permission and building regs and finally there is also a complete breakdown of the labour costs and materials. I had initially thought that the lender would be paying for these after just securing a plot with just outline planning permission. But it seems now that the lender will just lend on just the labour and materials, i.e. 1st stage lending will commence on digging out foundations. Have I got this correct? Assuming so, financially this does not concern me and I would be willing to pay these upfront costs, however the worry is I spend all this preliminary costs on a plot (to satisfy the lender) and the time it would take, surely this would take months to complete and I can't see the estate agent or land owner waiting for this duration and then there is the other risk that the land owner decides to sell to a cash buyer, therefore I would be at a loss financially and plot wise. Thanks -

Newbie Self-Builder - DIP / Fees / Costs Etc

delta9 replied to delta9's topic in Self Build Mortgages

Hi all, thanks for the input. My post was specifically aimed at the Self-Build mortgage costs, mainly the upfront costs to secure a plot ready for further funding towards the build. Yeah I've tried asking for transparency in regards of these costings, but at the moment it is unknown! Thanks -

Newbie Self-Builder - DIP / Fees / Costs Etc

delta9 replied to delta9's topic in Self Build Mortgages

Ok thanks for the post I am talking about pre-application costs (or my costs) before securing finance. I assume these surveys would be done pre-planning stage after plot purchase (and funded by the lender and not me). No not a typo! Where we live plots can be bought fairly cheap £10k - £40k will get a decent sized one enough for say 3 bed detached house or dormer. 150k for the land and building actually over estimated! -

Hi there, looking to self-build my first house to live in and I could do with some info from someone who has gone through the process before. I'm at the stage where the broker has calculated how much I can borrow to build with an estimated depost of 10% - 20 %. Nothing has been paid yet to the broker/lender and no credit search has been carried out (AFAIK). First question is the Decision in Principle (DIP). My confusion is normally on a standard residential mortgage, the lender will give you the DIP beforehand, so then you approach the estate agents (they ask for a copy of DIP), you view/submit offers and that gets the ball rolling... Then you starting chucking money into it (broker fees/deposit/solicitor fees /lender / surveys fees etc etc etc) But now on this self-build mortgage, I do not have a DIP beforehand, the broker has simply told me to find a plot (with outline or full PP) and let them know when I do so. So what happens when I find a plot from either an estate agent or the landowner, do I submit an offer on the plot and then go back to lender if estate agent accepts offer? (I would then have my plot cost). Is it after this stage I would get a DIP or rejection? Final question would be on the fees, what fees can I expect to be paying? I know the broker fee is about £1000 Lender's fee is currently unknown, but I assume this is probably another £1000 Land survey and other survey fees etc are these done before the lender will lend? Solicitor needed??? As you would with a normal mortgage this would be another £1000, but not sure if needed My self-build project is on a budget (under 150k for plot and build) so at this early stage I am trying to work out exactly how much cash is needed, Hope someone can help, at the moment everything is a bit vague on the actual 'Upfront' costings so thought I'd ask on here, appreciate any advice, thank you

-

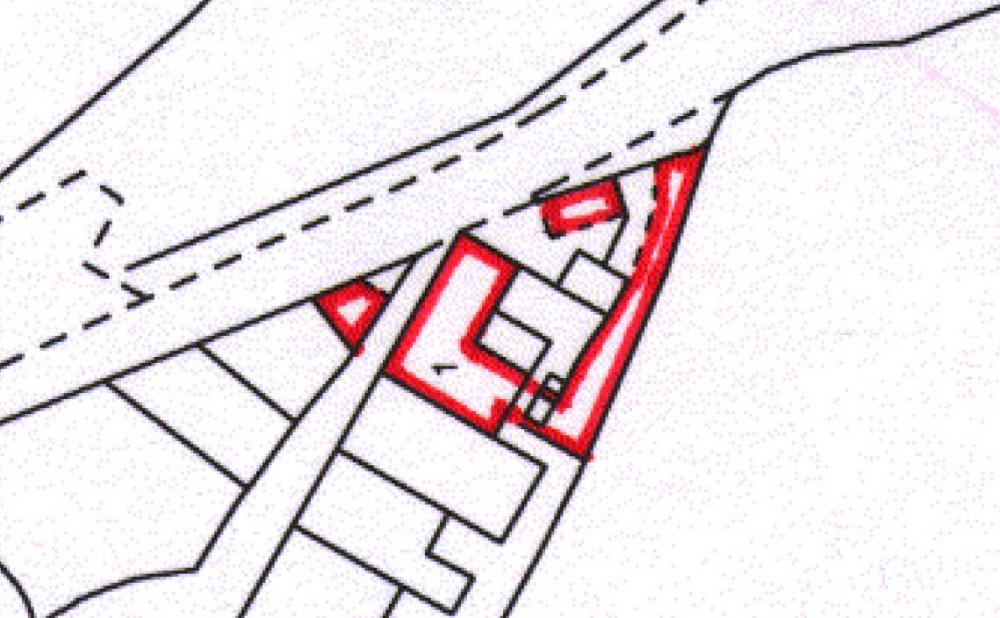

Hi there, new to the forum and looking for some guidance! Planning on purchasing a run down house to tidy up and live in. I have seen a few but came across this one with an odd title plan, the plan appears to be split up into multiple segments, I can see at least 6 pieces of land bordered. The title plan does mention "The mines and minerals together with ancillary powers of working are excepted". So I am assuming sometime in the past, the owner has decided to retain these odd bits of land, which is now mostly overgrown. The vendor has not mentioned any mine shafts etc and I've searched the mining map and nothing has come up to show this is a mining area. My plan was to maybe put an extension on the non-red areas or a garage or just simply clear the area as a garden, but now this does not look straight forward, I am sending off an index map search to get more information, just wondering if anyone has any advice or perhaps come across this situation before. It's a bit odd! If you look at the land next to the 10k green bit, that is the properties front garden, but why isn't the green bit not included? I appreciate their is a right of way to neighboring properties at the front, but that is not an issue. The area in red is freehold land. Thank you for any help and guidance